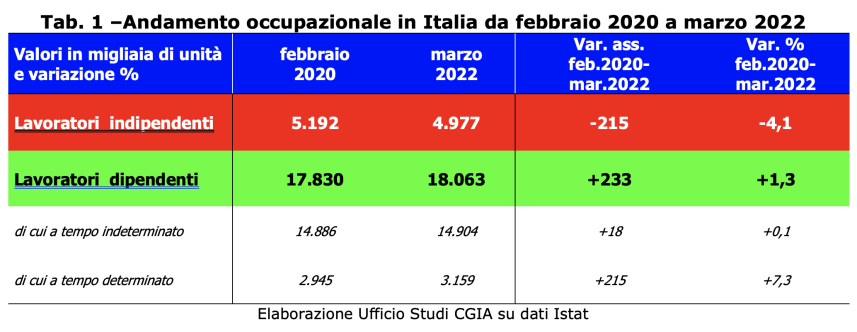

It is now a slow agony that the world of self-employment is experiencing. The economic effects caused by Covid have been very heavy. From February 2020, the month preceding the advent of the pandemic, to March of this year, the latest survey carried out by Istat, self-employed workers have decreased by 215 thousand units. If 2 years ago there were 5 million 192 thousand, at the end of the first quarter of this year they fell to 4 million 977 thousand (-4,1 percent). Still in the same period of time, however, employees increased by 233 thousand units, going from 17 million 830 thousand to 18 million 63 thousand (+1,3 per cent), although it should be emphasized that almost all of the increase it can be traced back to people who have been hired on a fixed-term contract in these two years. To say it is the Studies Office of the CGIA.

• Affected the most fragile and defenseless

These data unequivocally demonstrate that the deterioration of the economic situation caused by Covid in the last 2 years has affected the most fragile workers, those without any protection, those without any social safety net; ie the weakest part of our labor market. That is, artisans, small traders, VAT numbers, many young freelancers who, in the face of repeated lockdowns and the consequent fall in internal consumption, have been forced to throw in the towel definitively. However, given that the number of employees in the last 2 years has grown, it cannot be excluded that among those who have closed their business, some have returned to the labor market, becoming hired as employees.

• The increases in electricity and gas are paid twice

The exponential increase in prices, expensive fuel and bills could considerably worsen the economic situation of many families, especially those made up of self-employed. In recalling that about 70 percent of artisans and traders work alone, or have neither employees nor family collaborators, many artisans, small traders and VAT numbers are paying twice the extraordinary increase recorded in the last 6 months by the bills of electricity and gas. The first as home users and the second as small entrepreneurs to heat / cool and light their workshops and shops. And despite the mitigation measures introduced in recent months by the Draghi government, energy costs have exploded, reaching levels never seen in the recent past. Without waiting for Brussels, therefore, our government must intervene immediately, introducing a temporary ceiling on the price of gas at national level, as did Spain (last autumn) and France (at the beginning of this year). .

• "Black" work on the rise

Many of those who have closed their business permanently and have not been able to find a new job, probably continue to work in the "black". There are no official data yet, but the feeling is that Covid has contributed to significantly increase the number of illegal immigrants, i.e. those who lend their business illegally. This is the case of many squatters who pass themselves off as builders, painters, hairdressers / beauticians, carpenters, plumbers and electricians who in the last 2 years have provoked very strong unfair competition against those who carry out these activities in "clear". According to Istat, the army of "invisible" workers present in Italy is made up of 3,5 million people who go every day to the fields, construction sites, warehouses or homes of Italians to perform their irregular work . Being unknown to INPS, Inail and the tax authorities, the negative economic effects that these subjects produce are very heavy: in 2019 (latest data available) the added value produced by illegal work touched 77 billion euros.

• Are they also decreasing due to the war?

Although it is a partial fact, it seems that the advent of the war in Ukraine has also worsened the situation further. If in February of this year the independent workers present in Italy had returned above the threshold of 5 million (precisely 5.018.000), at the end of March they fell to 4 million 977 thousand units (- 41 thousand). It is evident that only the subsequent monthly surveys will allow us to understand if this trend will be confirmed. If this were the case, the decrease in the number of VAT numbers could also be attributable to the effects of the war which are contributing to the increase in the price of electricity and gas bills, the cost of transport and the growing difficulty in finding many raw materials.

• More and more shutters lowered

The closure of many small businesses can also be seen with the naked eye; just walk around to realize that there are more and more shops and shops with shutters down 24 hours a day. A phenomenon that is affecting both the historic centers and the suburbs of our cities, throwing entire blocks into abandonment, causing sense of emptiness and a dangerous deterioration in the quality of life for those who live in these realities. Less visible, but equally worrying, are the closures that have also affected freelancers, lawyers, accountants and consultants who carried out their activities in offices / studios located within a condominium. In short, cities are changing face: with fewer shops and offices they are less frequented, more insecure and with increasing levels of degradation. The loss of activity is also affecting those who have historically always been in competition with neighborhood shops; that is the shopping centers. Even the large-scale retail trade (GDO) is in great difficulty and there are not a few closed commercial areas that have entire sections of the property closed to the public, because the activities previously present have definitively lowered the shutters.

• Immediately a crisis table

For more than a year, the CGIA has been asking both Premier Draghi and the governors to open a permanent crisis table at national and local level. In fact, as never before, it is necessary to give an answer to a world, the autonomous one, which is experiencing a particularly difficult situation. Mind you, there are no solutions at hand. And we must not forget that in the last two years, in addition to the refreshments (although completely insufficient), the successive executives have, among other things, instituted the ISCRO, the universal allowance for dependent children and the emergency income for those still in business. Finally, with the very recent aid decree, even the self-employed with an income of less than 35 thousand euros will receive the one-off bonus of 200 euros in the coming months. Important measures, God forbid, but insufficient to face the difficulties caused by this situation of so severe crisis. For this reason we believe it is essential to set up a permanent crisis table at the MISE and in each individual region that addresses the problems described above with greater determination.