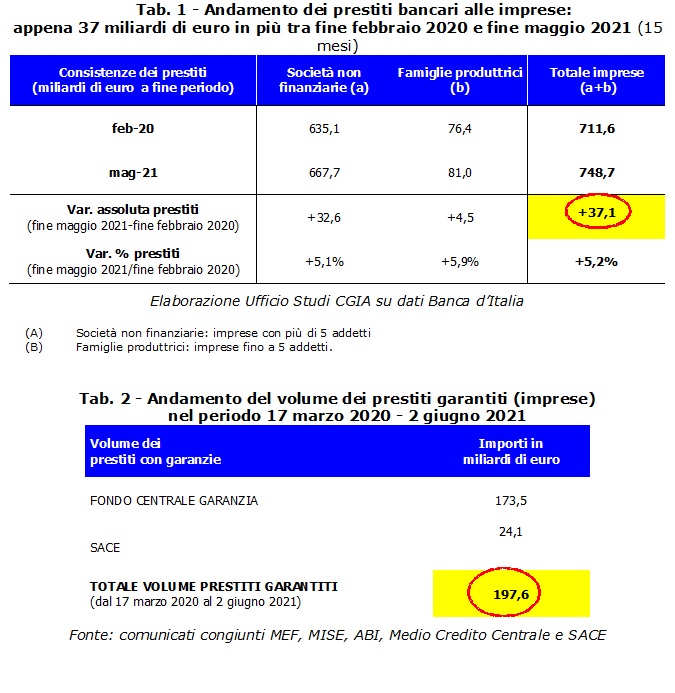

Between February 2020, the month that preceded the advent of the pandemic crisis, and May 2021, the total stock of bank loans granted to Italian companies to tackle the economic crisis increased by € 37,1 billion, although guaranteed loans put in place with the interventions approved by the second Conte government were 197,6 billion.

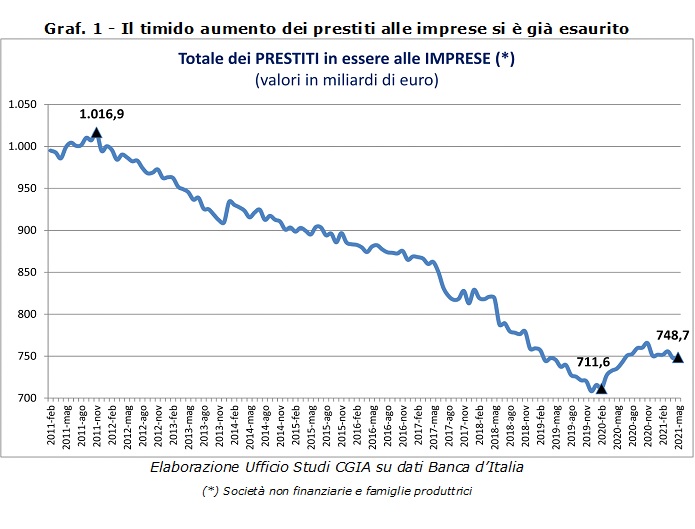

If these measures to support the liquidity of companies have in any case made it possible to overturn the trend that from November 2011 until the end of February 2020 had been constantly negative, the public guarantees introduced by the former premier Conte and also continued with the Draghi executive are not you are able to successfully tackle the chronic lack of liquidity that haunts, in particular, the world of SMEs. To say it is the CGIA Studies Office.

• Public guarantees have replaced private ones already in place before the advent of Covid

Why did only a little less than a fifth of the guarantees made available by the State through SACE and the Guarantee Fund, which by law cover almost all of the loans provided with these instruments, end up in the pockets of entrepreneurs? Firstly, because part of the new guarantees went to fill the physiological drops in existing credit and to replace short-term loans with increases in medium-long term ones. Secondly, because the banking system used a part of these billions also to reduce its own risks, replacing the private guarantees linked to the loans it had disbursed before the advent of these legislative innovations. A way of acting that has certainly favored the banks, which in so doing have eliminated the risks of incurring non-performing loans, and in part also businesses, at least those that before March 2020 had open credit lines with institutions. . In other words, the almost 200 billion of guarantees made available to the production system favored substitute credit to the detriment, however, of the additional credit, benefiting, in particular, the companies that had obtained loans before the advent of the crisis. Mind you, in principle the whole economic system has benefited from the application of these 3 measures, to which we must also add the moratorium on loans to families and businesses introduced by the second Conte government. However, the chronic lack of liquidity of SMEs was only partially attacked.

• The rise in business lending has come to an end

It is equally interesting to check the trend recorded in recent months by bank loans to businesses. Well, after the introduction of the measures developed by Conte bis (March 2020), the stock began to grow, reaching its maximum peak in November 2020, and then began a slow decline until last May when it reached 748,7. , 10 billion euros. In other words, we can affirm that, to date, the action to support businesses in credit matters has ended. With respect to the Bank of Italy, on the guaranteed loan front, the Task Force made up of MEF, MISE-Medio Credito Centrale, ABI and SACE update their data on credit to SMEs more frequently. Through “Garanzia Italia”, for example, up to 2.898 August, the applications submitted by large companies amounted to 27,3 and the volumes of guaranteed loans put in place by SACE reached 2.298.440 billion euros. Still on the same date, thanks to the “Cura Italia” and the “Liquidity Decree”, the Guarantee Fund for SMEs received 188,3 applications which “generated” 30 billion in loans. These latest figures also include mini loans up to € 1.165.502 which, on the other hand, recorded 22,7 applications, allowing for the disbursement of XNUMX billion in loans.

• Banks with low profitability cut credit and focus on financial services

The data unequivocally show that with the crises of 2008-2009 and 2012-2013, Italian banks have progressively reduced the flow of money to businesses. In defense of credit institutions, we must take into account the severe restrictions imposed at European level by the new obligations on capitalization, by the increase in non-performing loans and by the decrease in demand from companies deserving of liquidity. However, in 2020 there were not a few banks that recorded profits, even billionaires, which would impose, on the latter, greater "availability" towards the economic operators of our country. More generally, however, the real problem of our credit institutions is due to the low profitability that has forced many banks to diversify their revenues. Like ? By reducing the disbursement of loans which, with very low active interest rates, made this service less convenient than in the past. For these reasons, many institutions have shifted their business to less risky businesses. That is to say on ancillary and financial services. Furthermore, it should also not be forgotten that, although in sharp decline compared to a few years ago, bank non-performing loans still have significant economic dimensions. In light of this, many banks have been forced by European provisions to increase provisions and, consequently, to reduce credit disbursements or to grant loans on stricter terms. A situation that particularly penalized small businesses.