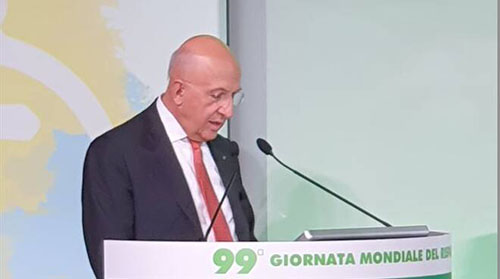

Report by the President of the Italian Banking Association Antonio Patuelli

The cruel conflicts in Ukraine and the Near East hit hard the fundamental principles of human dignity. The humanitarian aspects are the most seriously violated, but, after them, the risks to the economy should not be underestimated. These conflicts, in addition to the unacceptable violence, also lead to increases in energy costs and further inflationary pressures which may convince central banks to further monetary tightening, with new risks of weakening economic growth. In this very aggravated context, it is necessary to place a ceiling on the Italian public debt which cannot grow in absolute terms indefinitely and which takes away resources from public social initiatives and penalizes the international competitiveness of companies.

The decade of zero and sub-zero rates revolutionized the culture and habits of saving. Faced with inflation, rising rates and a decline in demand for credit, innovative reflections and initiatives are needed. Savings must always be respected and never forced by institutions and undue commercial pressure. Savings are fundamental energy for development and employment: we need to reform and rapidly reduce the tax burden on savings invested in the medium and long term in Italy. Investments of savings in the productive economy do not produce rents, but more or less risk-based returns.

It is important not to confuse and distinguish the returns invested in medium and long-term productive activities, compared to very short-term speculative operations. In Italy, only investments in public debt are facilitated, burdened by the reduced tax rate of 12,5% to encourage their placement.

Savings placed in liquidity are subject to the 26% rate. Investments in businesses of all kinds are subject to the maximum taxation: 24% IRES on profits, plus IRAP, plus 26% "dry coupon" on dividends received by savers, plus the capital tax on stamp duty and the 3,5% surcharge on bank profits. This is an overall taxation that exceeds 50% and does not encourage savings to be directed towards productive investments. We ask the ECB to fight inflation by avoiding a new recession: above all, development must be encouraged.

The monetary tightening consists of rate increases, a reduction in the ECB's purchases of government bonds, a surge in the costs for banks of TLTRO liquidity financing and the elimination of the remuneration of the compulsory reserve that banks must keep deposited in the banks. central. The monetary tightening accentuates the stronger competition between banks in the collection of savings, with a surge in returns for savers who invest liquidity with a pre-established duration, with rates competitive with those of Government Bonds.

Investments of savings in banks, especially with a pre-established duration, combat the risks of credit rationing in a phase in which liquidity in the market has been greatly reduced, a trend that will soon become accentuated with the conclusion of the latest TLTROs. Competition between banks is also gradually increasing returns on liquidity in current accounts (primarily instruments for collections and payments) which does not have a pre-established duration and cannot guarantee multi-year mortgages and stable loans to businesses and families.

State, banks and other public and private financial operators are in full competition in raising liquidity with rates and their durations. Savers obtain the best returns in cash investments by tying deposits to predefined maturities.

Competition in full legality, transparency and controls must always guarantee savers. After years of recapitalizations and restructuring carried out by shareholders and banks with sacrifices and a sense of responsibility together with trade union representatives and workers, the risks, including international ones, have grown again: there are new symptoms of credit deterioration which require further prudential provisions for the prospective strengthening of the capital solidity of the banks, a prerequisite for a solid economy.

We need to prepare in advance for the higher capital requirement thresholds imposed by the "Basel 3+" rules, while the risks of liquidity crises have grown: in the USA the recent banking crises have been liquidity crises. When, until just over a year ago, the rates on BOTs and banks' voluntary deposits in the ECB were negative, banks in Italy did not apply negative rates to savers. Banks in Italy have a greater load of fixed rate mortgages (over 60%) compared to variable rate ones.

The ABI has published a memorandum of banking initiatives to help borrowers in difficulty to cope with the growth of variable rates: only in Italy is there the possibility of renegotiating mortgage contracts even by moving them to competing banks. More flexible rules are needed for banks, businesses and families to restructure non-performing loans: we ask that the European Banking Authority (EBA) relax the inflexible regulations which greatly limit credit restructuring. On his last day of high responsibility as Governor of the Bank of Italy, we address Ignazio Visco sincere appreciation and thanks for his commitment in years of strong international, European and national complexities and of great transformations with the birth of the Banking Union European. Governor Visco, a multi-talented and very fine intellectual, must also be recognized for his anticipatory analysis of the negative effects of inflation, for his far-sighted commitment to balanced choices of European monetary policies and for having tackled the banking crises with the preventive bailouts which in 2015 were prevented by "errors of law" of the European Commission which suffered a double condemnation by the Court and the Court of Justice of the EU which ruled in favor of the Interbank Deposit Protection Fund and the Bank of Italy.

We extend our most sincere congratulations and best wishes for good work to the new Governor of the Bank of Italy, Fabio Panetta, who has gained very high cultural and professional qualifications and such important and decisive experiences, especially in particularly difficult years, at the top of the Bank of Italy. Italy and the European Central Bank.

The independence, impartiality and very high qualification of the Bank of Italy are founding values of Italy's solidity.