Have we finally canceled tax evasion? The question-provocation was launched by the CGIA Research Office which, on the basis of the data presented in recent weeks by the Ministry of Economy and Finance (MEF) and by the Revenue Agency, recalled that last year the The treasury collected, compared to 2021, 68,9 billion more in tax and social security revenue, recovered 20,2 billion in tax evasion and "stopped" 9,5 billion in fraud. This higher revenue, therefore, amounts to a total of 98,6 billion euros. An amount that is slightly smaller than the estimate of tax and social security evasion in Italy which, according to estimates, would amount to around 100 billion euros.

A provocation with a grain of truth

Can we therefore say that we have reset the evasion? Certainly not, although we have taken the right path towards its progressive reduction. In fact, a preponderant share of the 68,9 billion euro collected is attributable to the good performance of the economy last year which includes an amount – certainly limited but constantly increasing every year – attributable to the effects of tax compliance. Therefore, we can say that there is a fund of truth.

Here's who still doesn't pay

If we take into account the effects attributable to electronic invoicing, split payments and the control activity practiced by the tax authorities through the crossing of data present in their databases, compared to a few years ago, tax evaders have a harder time. Of course, not all. Those who are completely unknown to the taxman continue undaunted to get away with it, as do the mafia-type criminal organizations that continue to cultivate their illegal trafficking with ever greater dedication. Not too "sensitive" to fiscal loyalty are also those multinationals and web giants who, in Italy, make billions of dollars in profits, but pay the vast majority of taxes in countries with highly advantageous taxation.

Subscribe to the PRP Channel newsletter

The tax reform

While waiting for further information on the text approved last Thursday by the Meloni government, according to the CGIA Research Office, a tax reform that has the ambition to define itself as such must, first of all, indicate in advance how much it costs and where the coverage is recovered. after which it has the task of achieving, in a reasonably short time, at least three other objectives:

- the reduction of the tax burden on households and businesses;

- the simplification of the relationship between the tax authorities and the tax payer;

- the reduction of tax evasion and avoidance.

Failure to achieve these points constitutes a serious danger that the same is destined to fail or in any case unable to give a serious response to the many requests raised by taxpayers who have long been asking for a fairer and less complicated tax system.

The fiscal effort of our companies is at the top

Italian companies are among the most harassed in Europe. In comparison with the main EU countries, unfortunately, the percentage of tax revenue attributable to Italian companies out of the national total is clearly higher than, for example, that of Germany, France and Spain.

If in 2020 in Italy it reached 13,5 percent (guaranteeing a revenue of 94,3 billion euros), in Germany it was 10,7 percent (144 billion in taxes paid), in France it was 8 per cent (10,3 billion paid in) and in Spain 108,4 per cent (10,1 billion in proceeds). Compared to the European average we discount more than 41,7 percentage points more.

A further element which confirms the high level of taxation on our companies emerges from the comparison of the main rates which weigh on the taxable income of companies. If in Italy it stands at 27,9 percent, among our main competitors we see that it is 25,8 percent in France and 25 percent in Spain. Among the big names, only Germany, equal to 29,8 percent, suffers from a higher level than ours. Compared to the European average, the rate in Italy is 6,7 points higher.

Fiscal infidelity is more prevalent in the South

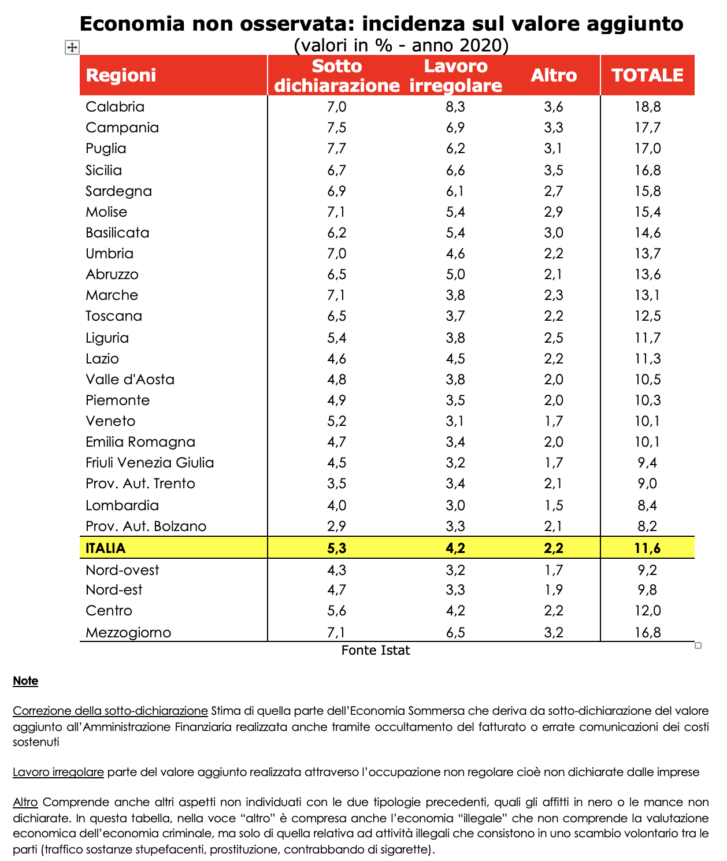

Although the latest available data from Istat (Territorial economic accounts. Report dated December 22, 2022) refer to 2020, a year strongly conditioned by the pandemic emergency, the percentage of the economy not observed (includes under-reporting, undeclared work and more – illegal activities, tips, undeclared rents, etc) on the regional added value recorded the highest thresholds in the South. If in Sicily it stood at 16,8 per cent, in Puglia at 17 per cent, in Campania at 17,7 per cent and in Calabria which, with 18,8 per cent, continues to be the region most at risk of 'Italy. The realities most faithful to the tax authorities, on the other hand, were the Autonomous Province of Trento with 9 per cent, Lombardy with 8,4 per cent and, the least affected by this sad phenomenon, the Autonomous Province of Bolzano with an incidence by 8,2 percent. The national average stopped at 11,6 percent.

The tax burden in 2022 has reached a record level

As we have recalled above, one of the main objectives of a serious review of our taxation system is to lighten the burden on taxpayers. In 2022, the tax burden in Italy, given by the ratio between tax revenues and GDP, reached 43,5 percent; a level never reached before.

The historic record achieved last year, however, is not attributable to an increase in taxation on households and businesses, but to the combination of three distinct economic aspects.

The first from a sharp rise in inflation, which drove up indirect taxes; the second from the economic and employment improvement that took place, in particular, in the first part of the year, which favored the growth of direct taxes and the third from the introduction in the two-year period 2020-2021 of many extensions and suspensions of tax payments, concessions that they have been canceled for 2022.

In addition to these three specificities, it should also be considered that starting from March 2022, Italian families receive the single allowance, a measure that has replaced the "old" deductions for dependent children. This novelty (all other things being equal) has obvious implications for the calculation of the tax burden. If the deductions reduced the personal income tax to be paid to the tax authorities, their abolition increased the total annual tax revenue by around 6 billion euros. We remind you that, now, the resources for disbursing the single allowance are accounted for in the state budget as expenditure.

Finally, in absolute terms, we point out that according to the data disclosed in recent days by the Ministry of Economy and Finance (January-December 2022), tax and social security revenues increased, compared to the same period of the previous year, by a total of 68,9 billion euros (+9,2 percent). Of these, tax revenues increased by 53,7 billion (+10,5 per cent) and social security contributions by 15,7 billion (+6,4 per cent) (Ministry of Economy and Finance, Press release no. 42, Rome 15 March 2023).