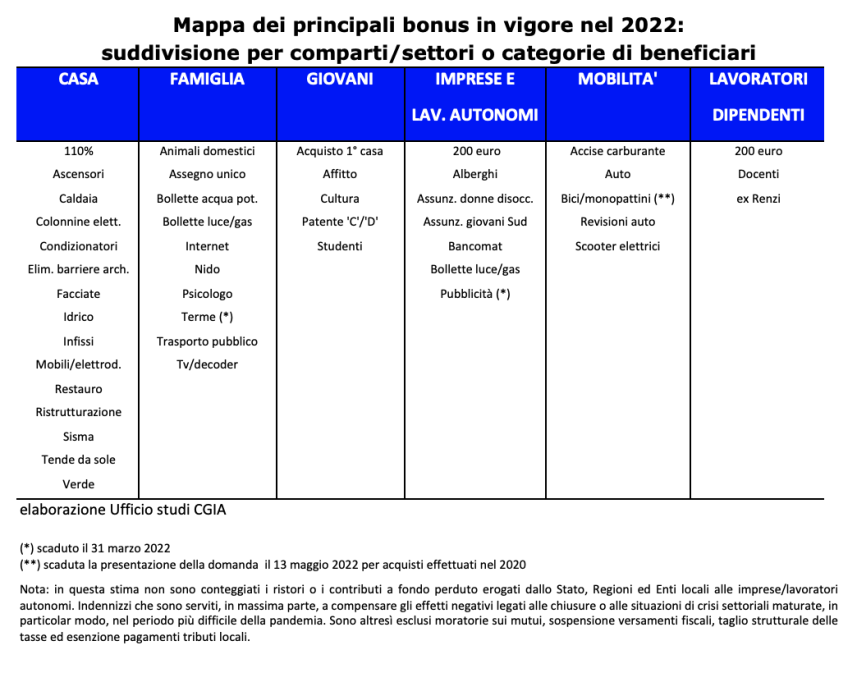

The main ones and still in force are just over forty and in this last three years (2020-2022) it is estimated that they will cost the State at least 113 billion euros (to be precise 112,7). We are talking about the bonuses introduced largely by the last two executives to deal with the negative economic effects caused by the pandemic and the war in Ukraine on some production sectors, families, employees and the self-employed. The analysis was carried out by the CGIA Studies Office.

Spending needs to be rationalized

It would be ungenerous to argue that a large part of this money has been and still is thrown to the wind, helping to significantly increase the public debt which, compared to the advent of Covid (2019), has risen by over 21 percentage points of GDP. Of course, many subsidies were also provided to those who did not need them, still others were introduced only to "collect" an immediate political consensus. All true: even if it should be emphasized that many of these anomalies have also affected other European countries. However, we believe that the time has come to rationalize spending. The economic and social scenario that is taking shape is increasingly gloomy, not to mention that by the end of this year the purchase measures of government bonds by the European Central Bank will be exhausted and that the same, following the soaring inflation will most likely be forced to raise interest rates. Measures that could worsen the stability of our public accounts. Therefore, given that the Draghi government does not seem willing, at least for now, to resort to the budget variance to recover the resources necessary to give some oxygen to our economy, all that remains is to cut current spending in order to recover at least one a large part of the resources needed to face the economic emergencies of recent months. In fact, other roads are difficult to follow; from the fight against tax evasion, the greatest revenues we manage to recover each year are very limited and a possible increase in revenue through an upward adjustment of taxes would not be practicable. The audience of bonuses, therefore, should be the most attentive to achieve the objective mentioned above. In other words, only from a "scissoring" of the outgoings for bonuses could we find the necessary coverage to fuel new economic policies of an expansive nature to counter, for example, the high bills and the surge in inflation.

The most expensive is the former Renzi

The most expensive for the public coffers is the former Renzi bonus: in the three-year period 2020-2022 the amount spent will amount to € 28,3 billion. Introduced in 2014, from 2020 the Conte II government has raised this measure to 100 euros. Compensation that was paid monthly in the paychecks of employees with an income level that over the years has fluctuated around 28 thousand euros. Since March of this year the amount of the measure paid to employees has dropped drastically, even if it is offset by the revision mechanisms introduced with the IRPEF reform which, however, do not penalize the workers economically. A bonus, the Renzi one, which served to weigh down the paychecks of Italians, with the aim of boosting household consumption. Equally expensive were also the building bonuses; according to the Revenue Agency, between the beginning of 2020 and the end of 2021 they cost the state coffers just under 25 billion euros. Although offset at least in part by the increase in taxation on extra-profits accrued by companies in the energy sector, the total cost of the social bonus amounts to 22 billion euros which, introduced in the second half of 2021 and extended / strengthened several times also in this first part of 2022, it is used to calm the increases in electricity and gas bills, especially for low-income families and energy-intensive businesses. Equally onerous was the cost for the community of the 110% super eco-bonus; entered into force in July 2020 to incentivize the energy requalification of our housing stock, as of March 31 of this year it cost the public budget, according to ENEA, 21,1 billion euros.

We need to speed up the "decalage" of building bonuses and for some to get to the stop

Of the approximately 113 billion euros of charges to the state estimated by the CGIA, 46 billion are attributable to bonuses that revolve around the construction sector. According to the Revenue Agency, in fact, in the two-year period 2020-2021 the amount of credit transfers and discounts on the invoice amounted to:

- 13,6 billion euros for the frontage bonus;

- 5,5 billion euros for the eco-bonus;

- € 4,9 billion for restructuring;

- € 0,9 billion for the seismabonus;

- 0,01 billion euros for charging stations.

To these amounts which, in total, total 24,9 billion, we must also add the deductions accrued for the completed construction works that made use of the 110% super eco-bonus. According to ENEA data, as at 30 April 2022 the burden on the state was 21,1 billion euros. Let me be clear, no one ignores the role that bonuses have had in recent years in relaunching construction, in bringing out the underground and in improving the energy efficiency of our homes; God forbid. However, the conviction of having spent excessively and having "drugged" the building / plant market is very widespread.

Consider, for example, that the restructuring bonus - initially with a tax rate of deduction of expenses incurred equal to 41 percent - was introduced 24 years ago, that is in 1998. By virtue of the fact that our country absolutely needs public resources to cope with the emergencies of this moment - such as the price of energy bills, the surge in inflation and the rise in the price of raw materials - money can only be recovered by cutting public spending, or by starting to gradually limit the bonus season and subsidies given to rain, often even to those who would not have any need.

In the construction sector, in truth, the decalage has already been programmed by the legislator, but still too slow. Instead, we need to accelerate the reduction of tax advantages and, at least for some, get to their zero, thus putting an end to the distributional distortion raised by many experts: the super eco-bonus of 110% and many other incentives have proven to be regressive, that is to have benefited, in particular, the higher income brackets who, more than the others, benefited from these "discounts".