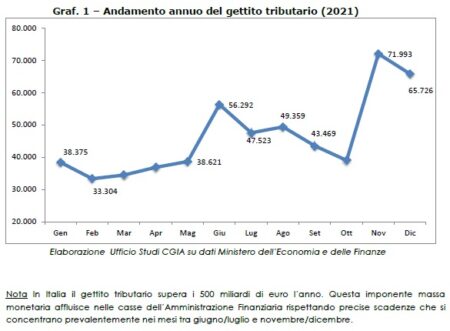

The November tax jam is coming, which has always been the most "rewarding" month of the year for the tax authorities

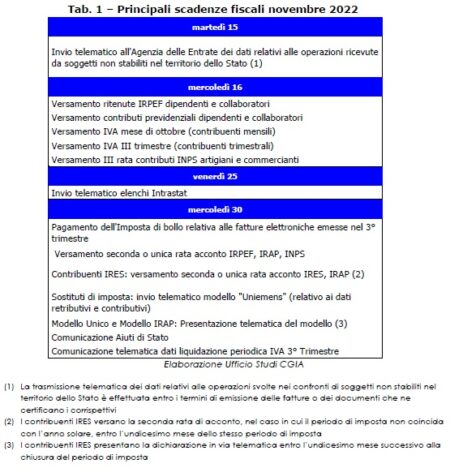

From the deadlines of November 16 and 30, in fact, the taxman will collect 69 billion euros. According to an estimate prepared by the CGIA Studies Office, companies, in particular, will be required to pay VAT (19 billion), IRES (16,2 billion), withholdings for employees and collaborators (12,5 billions). Furthermore, companies will also be required to honor IRAP (10,9 billion), the personal income tax advance of their employees (7,3 billion euros) and will also have to pay withholding taxes on the remuneration of professionals (1,2 , XNUMX billion).

Given the size of the revenue, many companies will have a lot of trouble getting through this flurry of tax deadlines unscathed. In fact, November is a real stress test that will allow entrepreneurs to measure the financial strength of their businesses.

The current month, we said, is also very special in another aspect. When an entrepreneur in difficulty for some time does not pass this "exam", he often decides within a few weeks whether it is worthwhile or not to continue the business.

Therefore, to avoid that many small entrepreneurs today in difficulty due to expensive energy, the boom in inflation and the contraction in consumption from permanently close the business, it is desirable that in a reasonably short time the new Government will drastically cut taxes, to order to "soften" also the payments relating to the most critical deadlines of each year: that is, the months of June-July and November-December.

Our tax bureaucracy is the worst in Europe

In addition to having one of the highest tax burdens in Europe, Italy, together with Portugal, is the country where paying taxes is more difficult, especially for companies. According to the latest available statistics prepared by the World Bank (Doing Business 2020), our entrepreneurs "lose" 30 days a year (equal to 238 hours) to collect all the information necessary to calculate the taxes due; to complete all tax returns and to submit them to the tax authorities; to make the payment online or with the appropriate authorities. In France it takes only 17 days (139 hours) to complete the bureaucratic tasks deriving from the payment of taxes, in Spain 18 (143 hours) and in Germany 27 (218 hours), while the Euro Area average is 18 days (147 hours). The data refer to a medium-sized company (limited liability company), in the second year of life and with about 60 employees.

December will also be a very busy month

Also next December will be particularly challenging on the fiscal front. In fact, by December 16, companies will have to pay social security contributions, welfare contributions and personal income tax for their employees and collaborators. They will also have to pay the advance of the substitute tax on income from revaluation of the severance pay, the balance of the Imu on warehouses, offices, shops and VAT for the month of November, provided they are monthly taxpayers. Finally, by Christmas they will also have to pay the thirteenth to their employees. In short, it cannot be excluded that many small entrepreneurs short of money will find themselves in serious difficulty in meeting all these tight deadlines.

Who does not pay, what happens to him?

If someone does not meet the tax deadlines set in the coming weeks, what are they going to face? The tax system, the CGIA Studies Office reminds us, imposes a penalty of 1 percent of the amount to be paid to the tax authorities on the taxpayer for each day of delay within the 15th day of the deadline. The percentage rises to 15 percent if payment is made within 90 days of the due date. For failure to pay or for payment made after 30 days from the deadline set by law, the penalty rises to 4 percent of the amount to be paid to the tax authorities. Regardless of the delay, interest equal to XNUMX per cent (per annum) of the amount to be paid is also due. Finally, it should be remembered that the penalties can be heavily reduced by taking advantage of the institution of "active repentance", provided that both the omitted amount and the (appropriately reduced) penalty and interest are paid. The reductions, of course, decrease with the passage of the payment time.