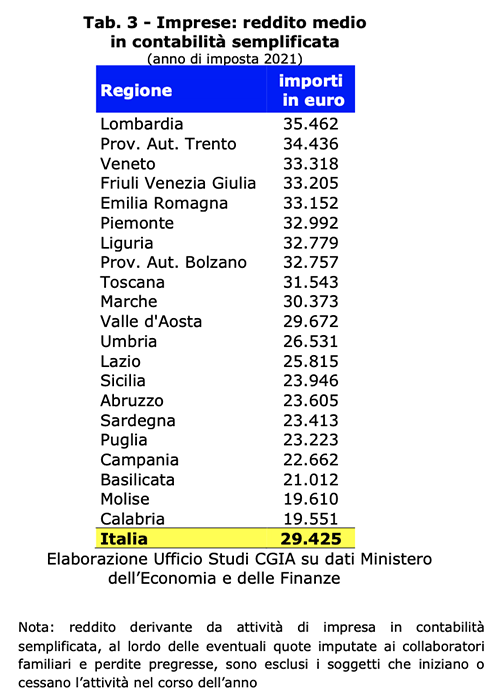

The bad bureaucracy that unfortunately grips most of our Public Administration (PA) causes economic damage to Italian taxpayers estimated at around 184 billion euros per year. The latter amount is more than double the size of tax evasion present in Italy. According to the Ministry of Economy and Finance (MEF), in fact, the lost annual revenue amounts to 84,4 billion euros (see Tab. 1).

• A provocation

What was denounced by the CGIA Research Office is a clear provocation that highlights an important aspect: in the "give-take" relationship between the State and taxpayers, the economic burden of the "distortions" caused by the PA to Italians has a clearly higher than the lost resources that dishonest taxpayers decide not to pay to the treasury. Having said that, if the quality of services offered by the public must absolutely be improved, it is even more necessary to combat tax evasion without any ifs or buts, wherever it lurks. Fiscal infidelity, in fact, is an unacceptable social/economic plague which, among other things, penalizes the weakest, because it reduces the quality and quantity of services offered by the public system. Not only. The thesis that not paying taxes would be "justified" because the state functions badly is not even plausible. If everyone paid what was requested, the PA would have more resources available, it would probably work better and the conditions would also be created to structurally cut the tax burden.

• Tax evasion is a problem, but the inefficiency of the PA is the country's problem

Premise:

the one mentioned above is a comparison that has no scientific value. We will see later, in fact, that the economic effects of the inefficiency of the PA that weigh on businesses are from different sources, the data are not homogeneous, sometimes the areas of application overlap and, for these reasons, they cannot be added.

Thesis:

however, it has its own conceptual rigor. In light of the figures mentioned, it leads us to say that a PA that functions poorly and poorly causes economic damage to taxpayers that is much greater, even more than double, than what the State suffers from those who do not fulfill their duty towards the tax authorities.

Conclusion:

tax evasion is a big problem that we absolutely must eradicate, but the real problem for our country system is to develop a precise, effective and efficient public machine.

• Wrong to generalize

Obviously it is always wrong to generalise, even our PA can count on points of excellence at central and local level which - in the sectors of healthcare, research, telecommunications, etc. – have no equal in the rest of Europe. However, the waste, squandering and inefficiencies present in our public bureaucracy are a bitter reality which, unfortunately, have and continue to hinder the modernization of the country.

• The critical issues of our PA

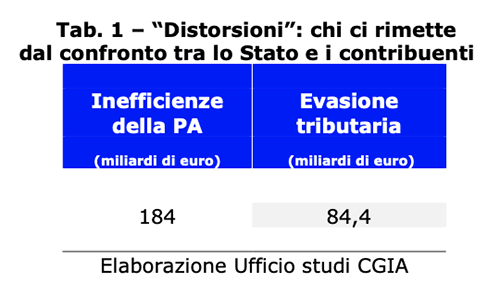

The CGIA Research Office has taken up and aligned the results of a series of analyzes of the main inefficiencies that characterize our PA. In summary they are:

- the annual cost incurred by companies for managing relations with the PA (bureaucracy) is equal to 57,2 billion euros (Source: The European House Ambrosetti);

- the commercial debts of the PA towards its suppliers amount to 49,6 billion euros (Source: Eurostat);

- the slowness of justice costs the country system 2 points of GDP per year which is equivalent to 40 billion euros (Source: Minister of Justice, Carlo Nordio);

- the inefficiencies and waste present in healthcare can be quantified at 24,7 billion euros every year (Source: GIMBE);

- the waste and inefficiencies present in the local public transport sector amount to 12,5 billion euros per year (Source: The European House Ambrosetti-Ferrovie dello Stato) (see Tab.2).

As we have already highlighted above, the economic effects of these malfunctions, taken from different sources, cannot be added together, also because in many cases the areas of influence of these analyzes overlap. However, these warnings do not affect the accuracy of the result of the comparison expressed above.

• The MEF's "unreliable" estimates on tax evasion by the self-employed

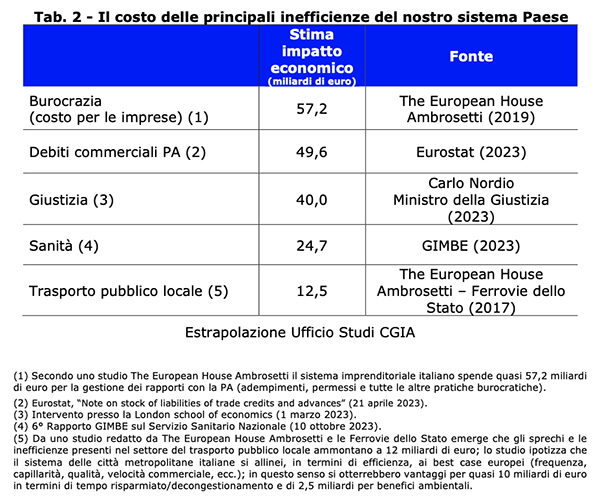

On the subject of tax evasion, the press and many authoritative commentators often cite data from the Ministry of Economy and Finance (MEF) which estimates the tax gap of tax revenues present in the country at 84,4 billion euros (average of period 2018-2020). Going into the detail of this analysis, the most evaded type of tax would be the Irpef for self-employed workers, for an amount equal to 31,2 billion euros which corresponds to a propensity for a gap in the tax which for years has steadily approached the 70 percent. This means, according to the authors of this elaboration, that just under 70 percent of the Irpef would not be paid to the treasury by self-employed workers. We do not go into the merits of the calculation methodology used, but we limit ourselves to demonstrating the "unreliability" of this result. According to the tax returns of self-employed workers in simplified accounting in the North (basically artisans and traders) they declared an average of 33 thousand euros gross in the 2021 tax year.

• 70% have no employees

We would like to point out that over 70 percent of these VAT numbers are made up of the sole owner of the company (in other words he works alone or, at most, together with a family worker). Well. If, as the MEF claims, these activities evade almost 70 percent of the Irpef, how much would they have to declare if they were compliant with the treasury's requests? 130 percent more, or almost 76 thousand euros per year. Now, how can they "reach" such a high income threshold in reality if the vast majority work alone, therefore they are little more than an employee, and at most they can work 10-12 hours a day, not to mention that during this period hourly must also deal with customers, with suppliers, with other companies, with the accountant, with the bank, with the insurance company and like all ordinary mortals can he get injured, get sick, etc., etc.?

• They are not the new "hungry people"

Obviously, no one can hide the fact that even among self-employed workers there are pockets of tax evasion that must absolutely be eradicated. However, it is another thing to claim that on average artisans and traders evade 70 percent of their income. Although calculated in a very refined way, when we "put it down", this assumption leads to unreliable conclusions. Not only. It is equally unbearable that many press outlets and many commentators use these estimates to accuse the self-employed of being "ugly, dirty and bad"; that is, the new "hungry people". Greater public knowledge of VAT numbers would prevent many observers from reaching conclusions that do not correspond to reality.

• In the North they declare 33% more than their colleagues in the South

Observing the tax returns by region of individual entrepreneurs in simplified accounting (tax regime which involves the vast majority of artisans and small traders), the income differences are very evident. If, on average, 33 thousand euros per year are declared in the North, only 22 thousand in the South. This means that 33 percent more are declared in the North. This range even tends to increase when the tax returns of individual businesses are analyzed in ordinary accounting. Obviously these gaps are certainly attributable to the different economic and social situations present in these two macro areas. However, the impact of survival tax evasion, which has significant dimensions in the South, is also of significant importance. In other words, the bulk of tax evasion involving VAT numbers is mostly to be found in the South, where the precariousness and marginalization of these workers reflects the strong economic hardship of this geographical distribution. Analyzing the data of the individual regions, as regards tax returns in simplified accounting, in Lombardy the self-employed declare 35.462 euros, in the province of Trento 34.436 euros, in Veneto 33.318 and in Friuli Venezia Giulia 33.205 euros. On the other hand, in Sicily it stands at 23.946 euros, in Puglia at 23.223 euros, in Campania at 22.662 euros, in Basilicata at 21.012 euros, in Molise at 19.610 euros and in Calabria at 19.551 euros. The national average is equal to 29.425 euros (see Tab.3).