Fiscal drag needs to be reintroduced

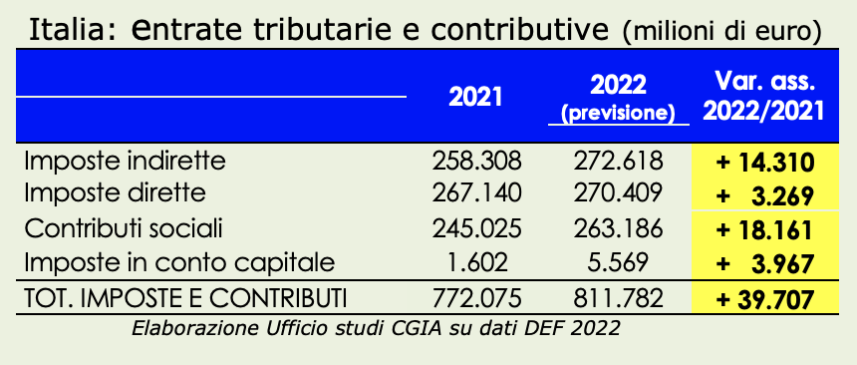

According to the DEF (Document of Economics and Finance presented to the Council of Ministers on 6 April 2022), the Italian state will collect 2022 billion more in taxes and contributions in 39,7 than last year. This forecast, the CGIA Studies Office reports, obviously cannot take into account the consequences that Covid and the Russo-Ukrainian war could cause in the coming months. However, if the estimate were confirmed, we would point out that part of this increase in revenue would also be attributable to the sharp rise in inflation which, according to forecasts, is set to reach almost 6 percent this year. In short, the hidden tax of inflation is on its way.

Therefore, at a time when families are suffering from appalling increases that could cause a vertical drop in domestic consumption, it would be desirable for the Government to return part of this extra revenue, reintroducing the tax drag (phenomenon that occurs when inflation generates an increase in the tax burden, even at the same rates, in the following way. Let's assume that in addition to prices, incomes also grow, but that this growth only compensates for inflation while maintaining this way the real income is unchanged. If the growth of monetary income were to be such as to bring the taxpayer into an income bracket burdened by a higher tax rate, this would end up paying more taxes on a real income equal to the previous one). A measure that would strengthen the purchasing power of retirees and employees, giving some relief especially to those who currently find themselves in serious economic difficulty.

The danger that our economy is slowly sliding towards stagflation is very high. The latter is a term unknown to the most unknown, also because it rarely occurs, that is when economic stagnation is accompanied by very high inflation that raises the unemployment rate. An economic situation that could also occur in Italy in a relatively short time. The difficulties linked to the post-pandemic, the effects of the war in Ukraine, the economic sanctions on Russia, the increase in the prices of raw materials and energy products risk, in the medium term, to push the economy towards zero growth , with inflation that would start to touch the two figures.

Countering stagflation, reports the CGIA Studies Office, is a very complex operation. To mitigate the inflationary pressure, experts argue that central banks should contain expansionary measures and raise interest rates, an operation that would allow a decrease in the money supply in circulation. It is evident that having a debt / GDP ratio among the highest in the world, with the increase in interest rates Italy would record a marked increase in the cost of public debt. A problem that could undermine our financial stability.

Finally, it is necessary to intervene simultaneously on at least two other fronts: firstly, through the drastic reduction of current expenditure and, secondly, with the cut in the tax burden, the only effective tools capable of stimulating consumption and for this food route. also the aggregate demand for goods and services. These latter operations are not easy to apply to an important extent, at least until the European Stability Pact is “reviewed”.