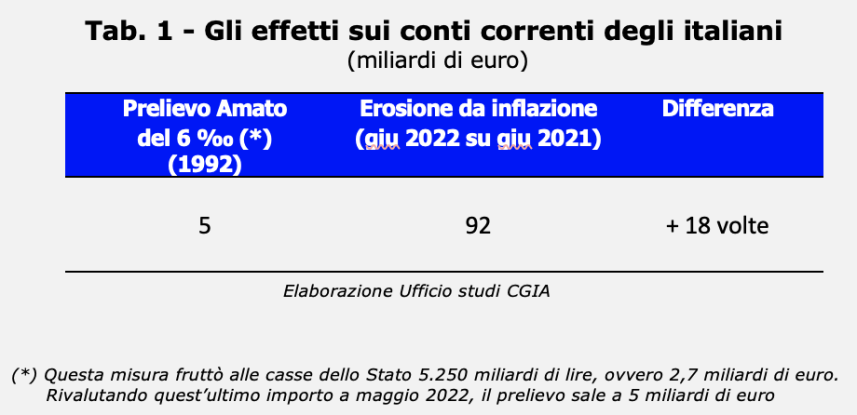

18 times more expensive than the Amato levy

Inflation is a tax of the worst kind, because it mainly affects those with less. Under certain conditions, the effects it releases are even more worrying; in particular, when it is "knocked down" as a balance sheet on current accounts. In a moment of difficulty like this, families think they have their "nest egg" safe; in reality it is a monetary illusion, since part of the savings is destined to "evaporate". How much? The CGIA Studies Office took care of the accounts. In purely theoretical terms, in fact, in this last year the increase in inflation has cost Italians over 92 billion euros. How did you come to this result? Taking into account that in the last 12 months the interest rate applied by credit institutions on bank deposits has been around zero and inflation, on the other hand, has grown by 8 percent (Istat, Consumer prices, Rome 1 July 2022), with savings unchanged, which amounted to a total of 31 billion as at 1.152 December last, the cost of living has eroded the latter by 92,1 billion euros.

The 6 per thousand imposed by Amato cost us 18 times less

The somewhat singular aspect of this whole story is that people struggle to grasp and quantify the negative effects of inflation on savings. After 30 years, for example, everyone still remembers with great anger the extraordinary levy of 6 per thousand imposed by the then Amato government on Italian current accounts. In fact, in the summer of 1992 that measure cost families 5.250 billion lire, or 2,7 billion euros. Reassessing this amount in May 2022, the levy rises to € 5 billion; practically an economic "sacrifice" 18 times lower than the 92 billion estimated, in the last year, by the CGIA Studies Office.

Lombardy, Lazio and Veneto are the most penalized regions

As expected, savers in the richest regions paid the highest cost at a territorial level: in Lombardy the loss of purchasing power was 19,4 billion, in Lazio by 9,3 billion, in Veneto by 8,3, 8,1 and in Emilia Romagna of 29,8 (In this simulation it has been assumed that the growth rate of inflation recorded in the last year is the same for all regions). The result that emerged from the comparison between the country's macro geographical areas is certainly a great surprise. If in the Northwest the "withdrawal" was as much as 22,8 billion, in the South it reached 20,7 billion; a figure, the latter, higher than the 18,8 billion recorded in the Northeast and, even more, compared to the XNUMX billion attributable to the Center.

We are sliding towards stagflation

The danger that our economy is slowly sliding towards stagflation is very high. The latter is a term unknown to most people, also because it rarely occurs, that is when very low (if not negative) economic growth is accompanied by very high inflation which causes an increase in the unemployment rate. An economic situation that could also occur in Italy in a relatively short time. With the difficulties linked to the pandemic, the effects of the war in Ukraine, the increase in the prices of raw materials and energy products, in the medium term, we risk seeing economic growth slide towards zero, with inflation which, instead, could shortly reach the two digits.

The counter measures to be taken

Countering stagflation, reports the CGIA Studies Office, is a very complex operation. To mitigate the inflationary pressure, experts argue that central banks should contain expansionary measures and raise interest rates, an operation that would allow a decrease in the money supply in circulation. It is evident that having a debt / GDP ratio among the highest in the world, with the increase in interest rates Italy would record a marked increase in the cost of public debt. A problem that could undermine our financial stability. Finally, it would be necessary to intervene simultaneously on at least three other fronts: firstly, through the drastic reduction of current expenditure and, secondly, with the cut in the tax burden, the only effective tools capable of stimulating consumption and for this food route. also the aggregate demand for goods and services. These latter operations are not easy to apply to an important extent, at least until the European Stability Pact is “reviewed”. Finally, we should definitely introduce a cap on the price of gas and fuel. Two voices that in the last 12 months have contributed significantly to dangerously raise our level of inflation.