Although the prices of raw materials have been falling in recent months, the importation of these products could cost the country at least 80 billion euros more this year than in the pre-Covid period. To say it is the Research Office of the CGIA.

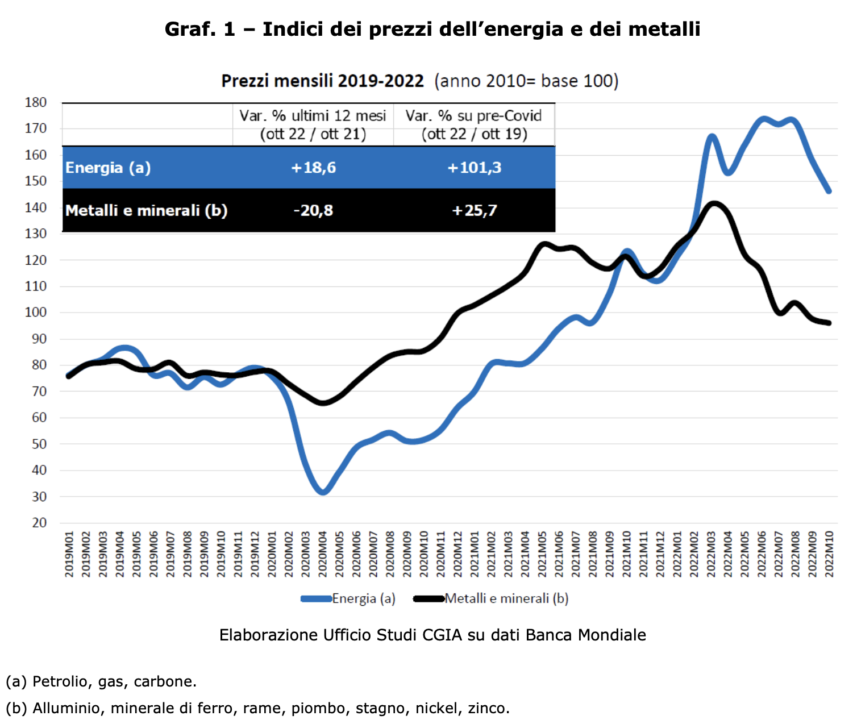

The prices of metals and minerals (aluminium, iron ore, copper, lead, tin, nickel and zinc), for example, have risen on average by 25,7 per cent in the last three years; energy costs (oil, gas and coal), on the other hand, doubled (+101,3 per cent).

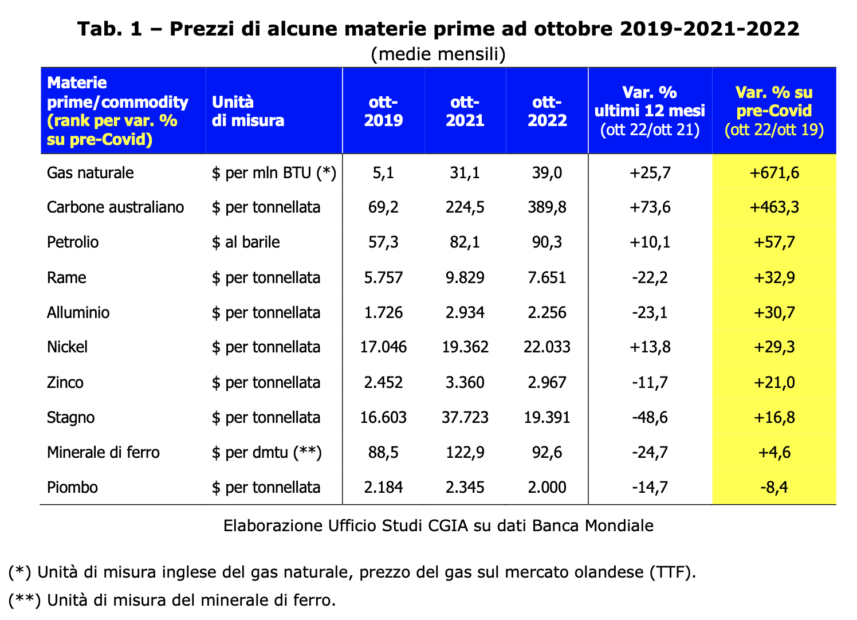

However, it should be noted that among the energy sectors, the increase in the price of coal was 463,3 percent and that of natural gas as much as 671,6 percent. On the other hand, the increases recorded for iron (+4,6 per cent), tin (+16,8 per cent), zinc (+21 per cent), nickel (+29,3 per cent), aluminum (+30,7 percent), copper (+32,9 percent) and oil (+57,7 percent). Again compared to 2019, among the raw materials examined by the CGIA on data from the World Bank, only lead suffered a decrease in price of 8,4 percent.

• The recovery in global demand has pushed prices up

More generally we can state that after a 2019 marked by substantial stability in the price index of these two commodity groups, starting from February 2020 (with the advent of Covid-19 and the consequent reduction in world demand) there has been a drop in prices (more marked for energy) which culminates in April 2020. Since May 2020, on the other hand, there has been a trend escalation of the indices of the two groups which takes more and more shape in the following months following the world economic recovery. Finally, this trend was only significantly interrupted in April 2022 for metals and in September 2022 for energy.

It should also be noted that in 2019, the price of the 2 commodity groups was well below the average levels of 2010 (the year which represents the 100 base of the graph) since after the 2009 crisis there was (as usually happens after a strong recession) to a progressive increase in price levels which completely eliminated the decreases that occurred during the recession and brought prices back to higher levels than pre-crisis levels (2008). Lastly, it should also be noted that, for metals, the price index for the month of October 2022 is slightly lower than the average figure for 2010; despite the significant drop in recent months, energy prices remain at very high levels which, as we said above, were double in October 2022 compared to the same period of 2019.

• Sea freight also contributed

The cost of maritime freight for containers has certainly also contributed to pushing up the prices of raw materials which, although in the last year it has suffered an average contraction of 68 percent, compared to the advent of the pandemic it has grown by 170 percent (Source: fbx.freightos.com). It should be remembered that about 90 percent of the international transport of goods travels by sea and a decisive role in container transport is held by the countries of the Far East. China, for example, with 14 ports in the overall top 20 controls over 54 percent of the world market share (Confindustria, "The increase in the cost of sea freight for containerized goods transport: reports from companies in the Confindustria system" , Rome 2021).

• Cut the tax wedge to keep employees from footing the bill

The increase in the prices of raw materials has caused the consequent increase in inflation which in our country is now in the double digits. This situation obviously affects everyone; especially fixed-income taxpayers who suffer a large loss of purchasing power. With "less" money in the pocket, domestic demand is evidently destined to decrease as well. The latest forecast data presented by the European Commission tell us that in 2023 the consumption of Italian families is destined to increase by an imperceptible 0,1 percent which, indirectly, will also penalize businesses and self-employed workers. If a large part of consumers do not buy, it is also completely superfluous to produce. Therefore, to get out of this vicious circle there is only one way to go: that of reducing the wedge which allows payrolls to become "heavier".