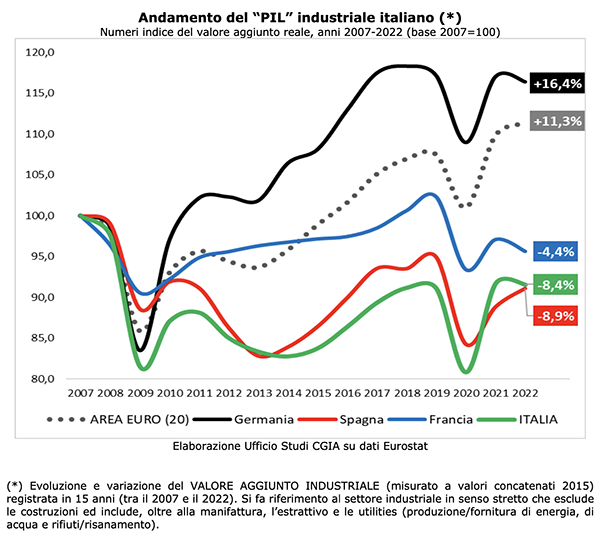

Although our industry in the strict sense contributes "only" 21 percent to the national GDP, between 2007 and 2022 the real added value of Italian manufacturing activity fell by 8,4 percent, in France by 4,4, 16,4 percent, while in Germany the change was positive and even equal to +8,9 percent. Among the main European countries, only Spain, with -XNUMX percent, recorded a worse result than ours. This is what the CGIA Research Office says.

Let us remember that from the end of the Second World War to today, the last 15 have been the most difficult years for most Western countries. As regards Italy, for example, the great recession of 2008-2009, the sovereign debt crisis of 2012-2013, the pandemic of 2020-2021 and the invasion of Ukraine by Russia in 2022 have profoundly changed the face of our economy. However, it is useful to highlight that between 2019, the year preceding the outbreak of the largest economic/health crisis since the Second World War, and 2022, the Italian manufacturing sector achieved a rebound greater than that recorded in the rest of the other main countries EU. In short, if we broaden the observation period starting from the subprime mortgage financial crisis we have not yet recovered the lost ground, otherwise, if we narrow it starting from the pandemic crisis that exploded 4 years ago, no other major European manufacturing industry has.

Therefore, it is likely to believe that the 2008-2009 and 2012-2013 crises have certainly reduced and weakened the number of manufacturing companies present in Italy, but have strengthened the resilience and performance of those remaining on the market which, compared to foreign competitors, have overcome the negative effects caused by the 2020-2021 pandemic crisis with greater momentum.

The success recorded especially in the last two years by our made in Italy products in all the main world markets is, in fact, confirmation of the thesis just exposed.

- Top extractive, pharmaceutical and food also good. Bad oil, wood and chemical refining

The sector in Italian industry which has suffered the heaviest negative contraction in added value in the last 15 years has been coke and oil refining (-38,3 percent). This is followed by wood and paper (-25,1 percent), chemicals (-23,5 percent), electrical equipment (-23,2 percent), electricity/gas (-22,1 percent). hundred), furniture (-15,5 percent) and metallurgy (-12,5 percent). On the other hand, however, the sectors that show an anticipated change from the plus sign are machinery (+4,6 percent), food and beverages (+18,2 percent) and pharmaceutical products (+34,4 percent) . Among all the divisions, the pink jersey goes to the extractive sector which, although it has a relatively limited added value in absolute terms, has recorded a frightening increase of 15 percent in 125 years.

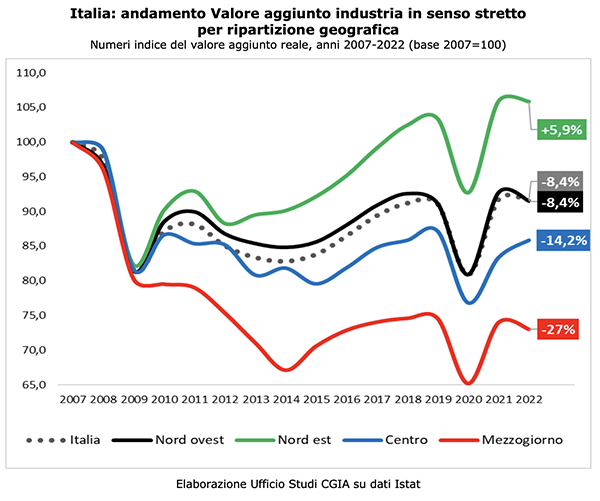

- The South collapsed. Only the Northeast held

Also between 2007 and 2022, the real added value of the industry in the South collapsed by 27 percent, that of the Center by 14,2 percent and in the Northwest by 8,4 percent. Only the Northeast[5] recorded a positive result which reached +5,9 percent.

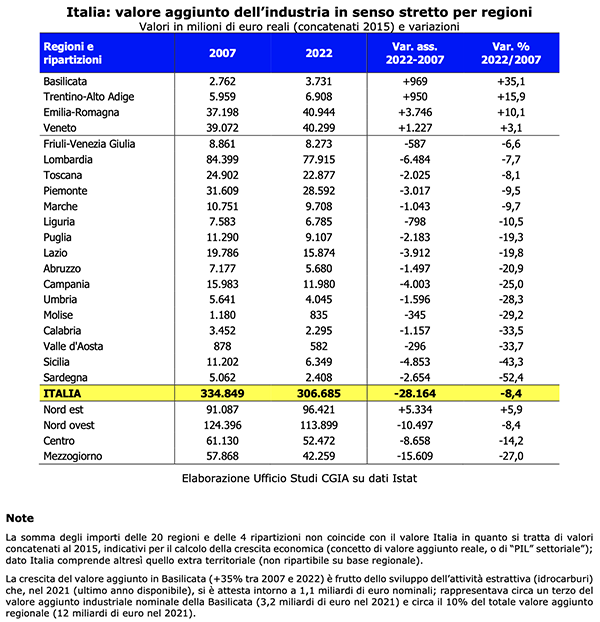

At a regional level, it is the companies of Basilicata that have recorded the growth in the added value of the most important industry (+35,1 percent). A result which, according to the CGIA research office, is largely attributable to the excellent results achieved by the extractive sector, thanks to the presence of Eni, Total and Shell in the Val d'Agri and Valle del Sauro. In second position is Trentino Alto Adige (+15,9 percent) which was able to count on the score of the agri-food sector, energy distribution, steel mills and mechanical companies. In third position, however, we see Emilia Romagna (+10,1 percent) and just off the podium Veneto (+3,1 percent). From fifth place onwards, all Italian regions show a negative change in growth in added value. The most critical situations occurred in Calabria (-33,5 percent), in Valle d'Aosta (-33,7 percent), in Sicily (-43,3 percent) and in Sardinia (-52,4 percent). percent).

- Milan, Turin and Brescia remain the most industrial provinces in the country. Booming growth in Trieste, Bolzano and Parma

At the provincial level, Milan (with 28,2 billion euros of nominal added value in 2021) remains the most "manufacturing" area in the country. Followed by Turin (15,6 billion), Brescia (13,5 billion), Rome (12,1 billion) and Bergamo (11,9 billion). Of the top 10 most industrialized provinces in Italy, 7 are located along the A4 motorway. Among all the 107 provinces monitored, the one that recorded the highest growth in nominal industrial added value between 2007 and 2021 was Trieste (+102,2 percent). Immediately afterwards we see Bolzano (+55,1 percent), Parma (54,7 percent), Forlì-Cesena (+45 percent) and Genoa (+39,5 percent). The territories, however, where the losses in added value were more significant concerned Sassari (-25,9 percent), Oristano (-34,7 percent), Cagliari (-36,1 percent), Caltanissetta (- 39 percent) and Nuoro (-50,7 percent).

Subscribe to our newsletter!