Prato, Milan, Naples, Rome and Caserta are the realities most at risk. Among the crimes reported last year, only usury increased

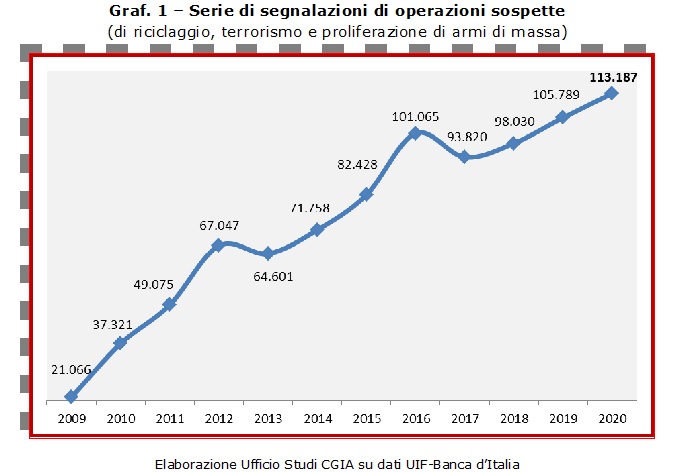

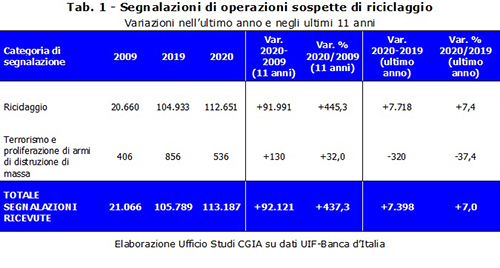

Also due to the economic effects of the pandemic, suspicious money laundering reports received by the Bank of Italy's Financial Information Unit (UIF) are on the rise. In 2020 there were 113.187 (+7 per cent on 2019): a threshold, the one in absolute value, never touched in previous years.

Over 99 per cent of the total of these "reports" concern money laundering operations which, most likely, are of illegal origin and only 0,5 per cent, on the other hand, are attributable to suspected measures of terrorism and proliferation of weapons of mass destruction.

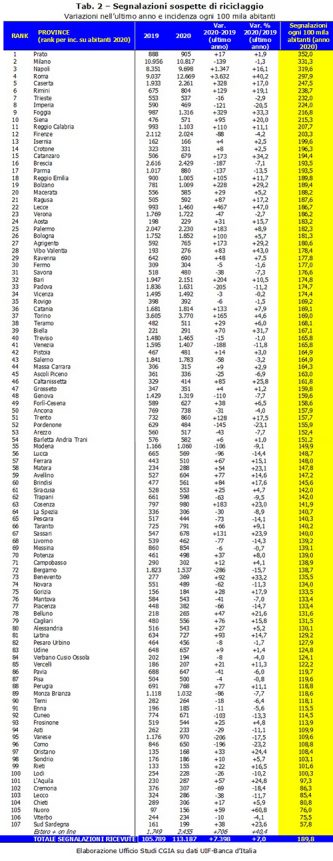

At the territorial level, the most critical situations were recorded in the provinces of Prato (352 reports per 100 thousand inhabitants), Milan (331,3), Naples (319,6), Rome (297,9) and Caserta ( 247,5). The less involved provinces, on the other hand, were those of Nuoro (76), Viterbo (75,5) and Southern Sardinia (57,8).

• Crimes in decline, but not usury

As the UIF itself denounced in the Parliamentary Commission of Inquiry into the phenomenon of mafias last January, the infiltration of criminal organizations into the country's productive fabric occurs more and more often through the use of usurious or extortionate activities against activities that, compared to others , have been most affected by the pandemic crisis.

In particular to those that belong to real estate, construction, cleaning services, textiles, tourism-hotels, catering, transport, etc.

Although provisional, it should be noted that in 2020, following the closures imposed on economic activities and the confinement measures to which Italians were subjected, the complaints received by the police in reference to crimes against property decreased significantly :

• extortion (-6 per cent);

• damages (-15,4 per cent);

• robberies (-18,1 per cent);

• receiving stolen goods (-26,5 per cent);

• thefts (-32,9 per cent);

• counterfeiting (-43,5 per cent).

In contrast only computer scams / fraud (+14,4 percent) and, unfortunately, usury (+16,2 percent).

• Turnover of criminal organizations up to 170 billion

Although there is no statistical homogeneity among the research institutes that monitor the "penetration" of criminal organizations in the economy of our country, the turnover of organized crime is certainly very important. According to Istat, for example, in Italy it would amount to 19,3 billion euros (data referring to 2018), while the Catholic University of the Sacred Heart-Transcrime estimates a turnover that would reach 30 billion euros (year 2014). Finally, the Bank of Italy, in its not very recent study, took the quantity of money in circulation as a reference parameter. Well, the researchers of via Nazionale have come to the conclusion that the illegal economy present in Italy between 2005 and 2008 could have accounted for over 10 percent of GDP: or around 170 billion euros.

• Bank lending to businesses collapsed

The increase in reports of money laundering could find its "justification" in relation to the fact that in recent years bank loans to businesses have undergone a very marked decrease. Therefore, it cannot be excluded that having received much less money from credit institutions, many entrepreneurs, especially small ones, have turned to those who could provide credit with a certain ease. Between March 2011 (maximum peak of disbursement of bank loans to businesses) up to the same month of this year, in fact, Italian companies suffered a credit squeeze equal to 250,2 billion euros (-22,4 per cent ). However, it should be noted that, in the last year, thanks to the measures to support SMEs put in place by the Conte government, bank loans have increased by almost 50 billion (+7,5 per cent). An important but momentary reversal of trend and, in any case, completely insufficient to bridge the vertical fall suffered in the last decade.

• Over 176 thousand “registered” companies: they are those most at risk

However, there are just over 176 thousand Italian companies that have non-performing loans. In other words, we are talking about companies and VAT numbers that appear to be "registered" at the Central Credit Register of the Bank of Italy as insolvent. A classification that, in fact, prevents these economic subjects from accessing loans provided by banks and financial companies. A condition which, obviously, does not allow to take advantage even of the facilitated measures approved last year with the “Liquidity decree”. Not being able to resort to any financial intermediary, these SMEs, structurally short of liquidity and in great financial difficulties, in this period of credit shortage are much more likely than others to slip into the arms of loan sharks. To avoid all this, it is necessary to encourage the use of the “Fund for the prevention” of usury. An instrument, the latter, present for decades, but little used, also because it is unknown to most and, consequently, with scarce economic resources available.

• The confirmation also from the Ros: the companies without liquidity are easy prey of the mafias

An audience of companies, those reported to the Central Credit Register, which is almost forbidden to ask for "support" from banks which, compared to others, are the most exposed to the risk of being "approached" by criminal organizations. A thesis that was also confirmed by the leaders of the Ros (Special operational grouping). In an interview released in the main economic newspaper of the country well before the advent of the pandemic crisis, the commander Pasquale Angelosanto pointed out how the mafia hold an enormous amount of liquidity coming from illegal operations to be reintroduced into the market. Often, double-breasted managers offer themselves to companies in difficulty as solvers of these crises. In short, they present themselves as a bank, even if they then apply very different rules. The loan disbursed becomes the "picklock" to acquire a significant stake in the corporate administration of the company. As the entrepreneur is no longer in a position to repay the sum received, over time the criminals become the new owners.