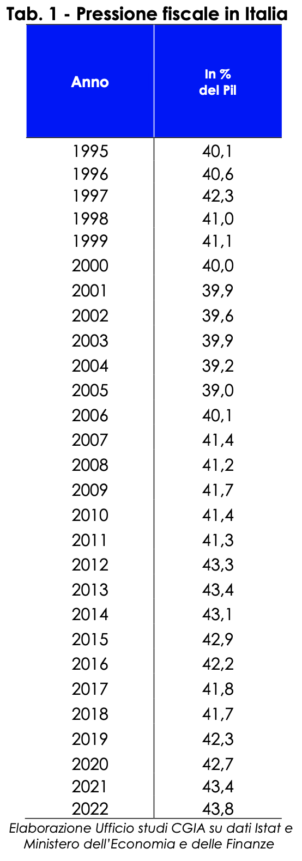

The tax burden in Italy, given by the ratio between tax revenues and GDP, reached 43,8 per cent (Economic and Financial Document 2022. Update Note. Revised and integrated version. Council of Ministers of 4 November 2022, page 13); a level never touched before.

The CGIA Studies Office reports that the historical record reached this year, however, is not attributable to an increase in taxation on families and businesses, but by the interaction of three distinct economic aspects. The first is a sharp rise in inflation, which has caused indirect taxes to rise; the second from the economic and employment improvement that took place in the first part of the year, which favored the growth of direct taxes and the third from the introduction in the two-year period 2020-2021 of many extensions and suspensions of tax payments, concessions that were canceled for the 2022.

In addition to these three specificities, it should also be considered that starting from March of this year Italian families receive the single allowance, a measure that has replaced the "old" deductions for dependent children. This change (all things being equal) has obvious implications for the calculation of the tax burden. If the deductions reduced the personal income tax to be paid to the tax authorities, their abolition increased the total annual tax revenue by about 8,2 billion euros. Recall that, now, the resources to disburse the single allowance are accounted for in the state budget as expenditure.

In absolute terms, finally, we point out that according to the data released in recent days by the Ministry of Economy and Finance (January-September 2022), tax revenues, compared to the same period of 2021, increased by 37 billion euros: of which 5,5 billion for personal income tax, 8,9 billion for Ires and 17,8 billion for VAT (Press release no. 181. Rome, 7 November 2022).

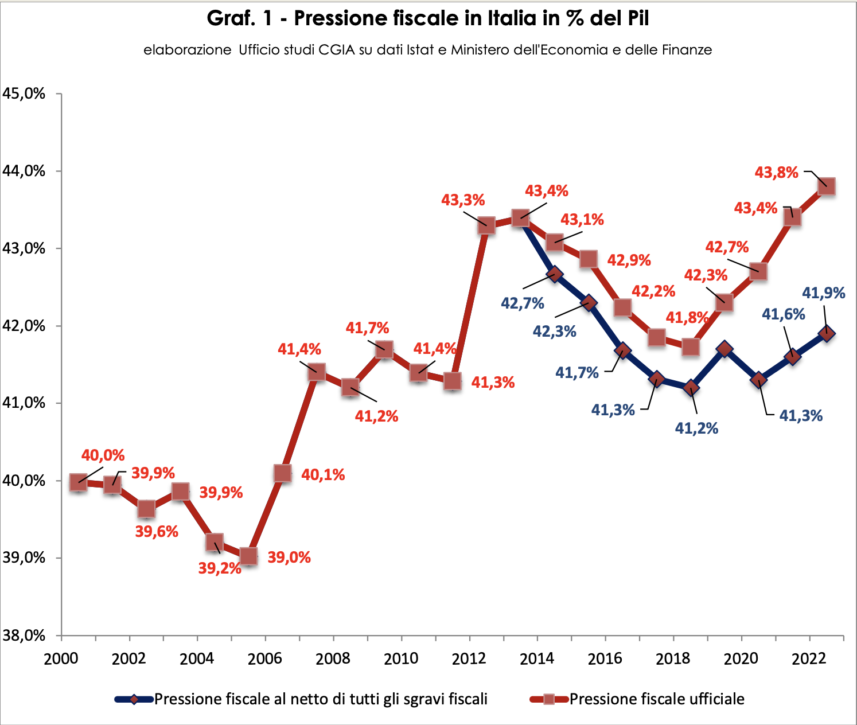

With the introduction of the Renzi bonus, since 2014 the tax burden in Italy has a double reading: that net of tax relief - which in 2022 reached 41,9 per cent of GDP - and the official one which touches the maximum peak of 43,8 percent.

In truth, there is also a third version: the real one obtained by purifying the share attributable to the unobserved economy from the national GDP which, by its nature, does not “produce” revenue. Recalling that the tax burden is equal to the percentage incidence of the ratio between tax revenue and GDP, if the latter term decreases (because the share attributable to the undeclared is subtracted), the final result increases. For the current year, in fact, the real tax burden on taxpayers loyal to the tax authorities is now approaching 50 percent.

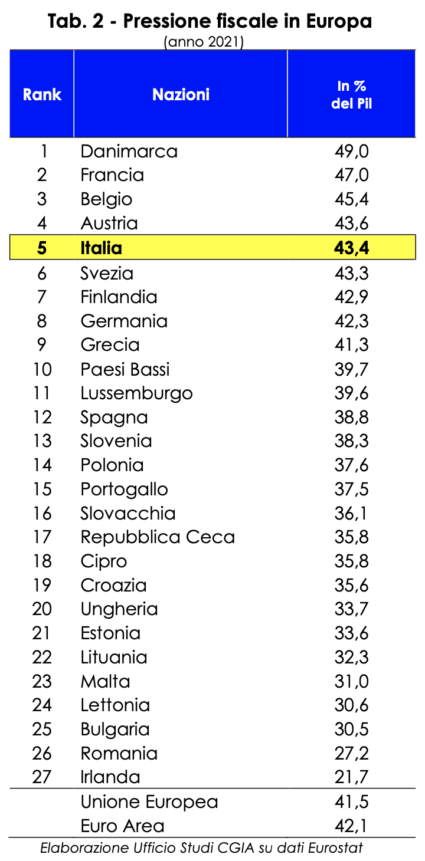

When analyzing the tax burden of other EU countries, for reasons of homogeneity of the data, reference must be made to the official tax burden. In fact, the rules that require many tax reliefs and subsidies, such as the single allowance for dependent children, to be recorded as higher expenditure and not as lower income, are the same for all countries. That said, the latest available data referring to 2021 tell us that in the EU27 Italy is in fifth place. Only Denmark (49 percent of GDP), France (47 percent), Belgium (45,4) and Austria (43,6) have a tax burden higher than ours (43,4 percent of GDP). If in Germany the tax burden is 42,3 per cent, in Spain it is 38,8 per cent and in Ireland (the country with the lowest level in the entire EU) it is even 21,7 per cent.

In addition to having one of the highest tax burdens in Europe, Italy is the country where paying taxes is also more difficult, especially for companies. The tax bureaucracy, in fact, has impressive dimensions. Not only. We pay a lot but receive little in return. Of course, our Public Administration also has peaks of excellence in some sectors that cannot be found elsewhere. On average, however, the quality and quantity of services provided to citizens and businesses is much lower than the European average. Returning to the topic of tax bureaucracy, according to the latest available statistics prepared by the World Bank (Doing Business 2020), Italian entrepreneurs, like their Portuguese colleagues, "lose" 30 days a year (equal to 238 hours) to collect all the information necessary to calculate the taxes due; to complete all tax returns and to submit them to the tax authorities; to make the payment online or with the appropriate authorities. In France it takes only 17 days (139 hours) to complete the bureaucratic tasks deriving from the payment of taxes, in Spain 18 (143 hours) and in Germany 27 (218 hours), while the Euro Area average is 18 days (147 hours). The data refer to a medium-sized company (limited liability company), in the second year of life and with about 60 employees.