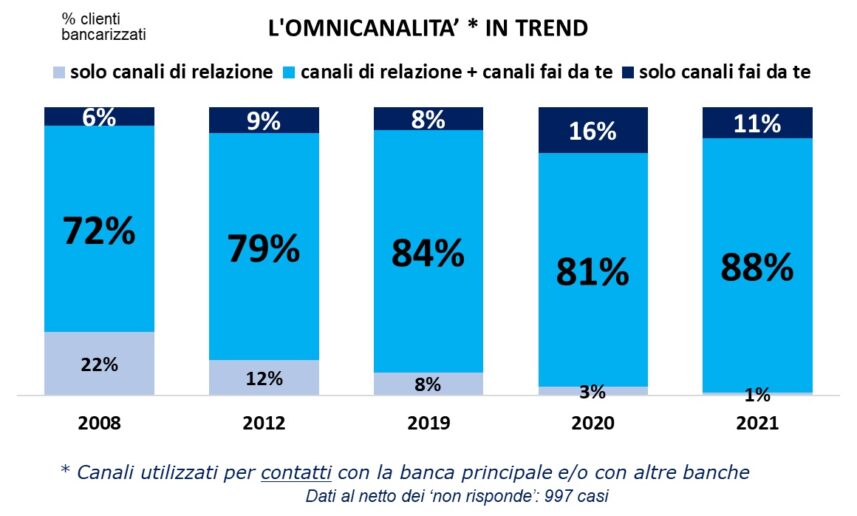

More and more customers access the bank using different channels and in a combined way, almost 9 out of 10 according to the latest survey carried out by ABI, in collaboration with Ipsos. In 88% of cases (+7 percentage points compared to the previous year), in fact, customers manage the relationship with the bank alongside the use of the 'do-it-yourself' channels ideal for carrying out transactions in speed and mobility (ATMs ATM, Internet banking and Mobile Banking) those in which you can interact with personal contacts (agency, contact center, chat with operator and financial consultant). In a scenario of increased synergy between the physical and digital channels made available by the banks, the customer experience thus acquires a new centrality, supported by the innovation of the distribution models that see renewed both the physical spaces and the dialogue functions and assistance services .

The ABI survey with Ipsos was carried out as part of the activities of the Observatory dedicated to the evolution of the relationship between banks and customers on a representative sample of bankers aged 18 to 74 in December 2021.

More involvement with customer tailored services

The survey shows how customers increasingly appreciate the possibility of counting on 'tailor-made', simple and reliable solutions. The versatility of the solutions offered in response to the new and diversified needs of customers, in fact, reinforces the positive perception of the customers' experience in the relationship with the bank. At the same time, customers feel more involved in the relationship with the bank and take an active role by testifying their experience. In fact, the survey highlights the share of customers who have spoken well of their bank or who are willing to give positive 'word of mouth' equal to over 2021% in 80 (it was 69% in 2019).

More attention to the values of sustainability

The survey shows how knowledge of sustainable investments (ESG, from English Environmental, Social and Governance), albeit still limited, hand in hand with the propensity to choose an investment in sustainable finance, is spreading in particular among "evolved That is, who habitually use the Internet and who use the online current account, between the investors themselves and those who already know this opportunity. According to the survey, 1 evolved banker out of 5 declares to consider attractive investments focused on companies committed to reducing pollution, defending the earth's resources and protecting employees and their health.