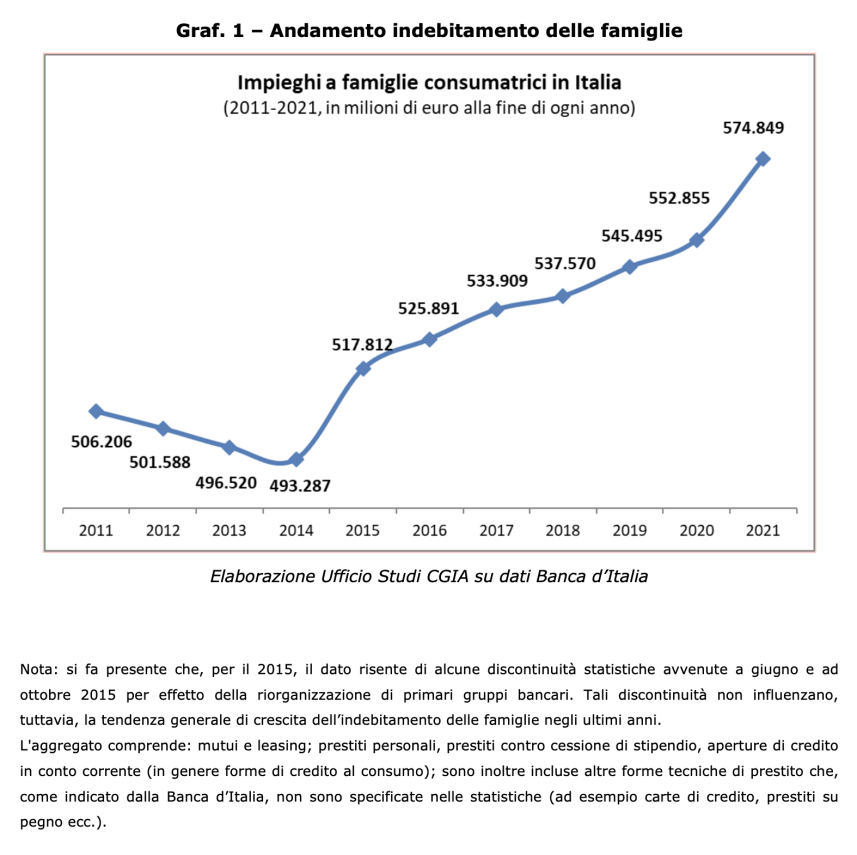

The debt of Italian households is growing (aggregate includes: mortgages and leasing; personal loans, loans against salary assignments, current account credit openings (generally forms of consumer credit); other technical forms of loans are also included which, such as indicated by the Bank of Italy, are not specified in the statistics (e.g. credit cards, pledges, etc.).

At 31 December 2021 it amounted to a total of 574,8 billion euros (+21,9 billion compared to a year earlier).

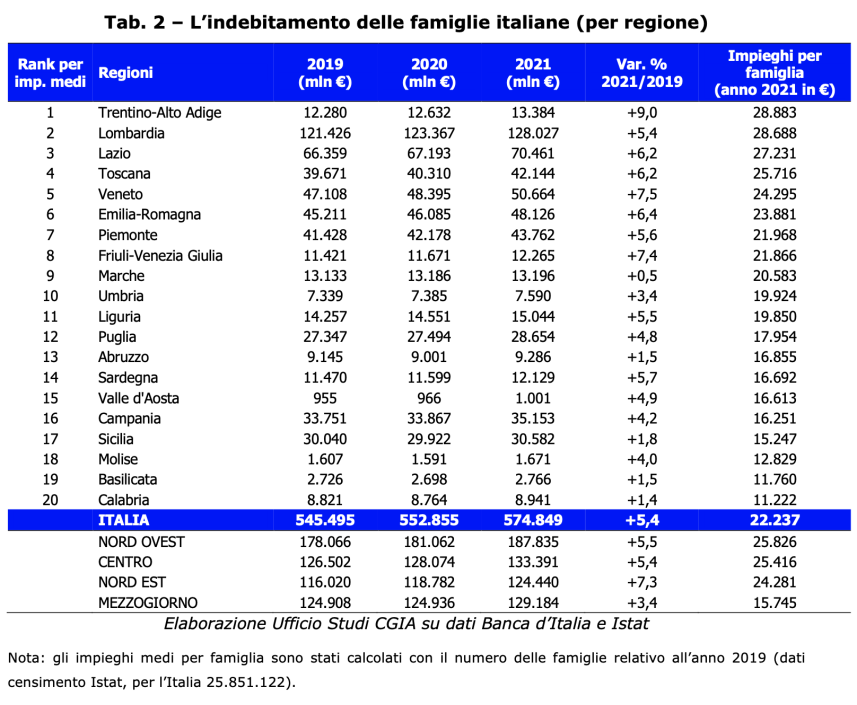

The average amount per household was 22.237 euros; if compared with the figure of 12 months earlier, the change was positive and equal to 851 euros.

What worries the CGIA Studies Office, however, is not so much what one is able to measure, but what one cannot even glimpse; such as, for example, the risk of usury. A phenomenon, the latter, which has always been difficult to measure, even when there are recent statistical data on the number of complaints notified to the police. Let alone now, that the latest available data refer to a couple of years ago.

CRITICAL, BUT NOT DRAMATIC SITUATION

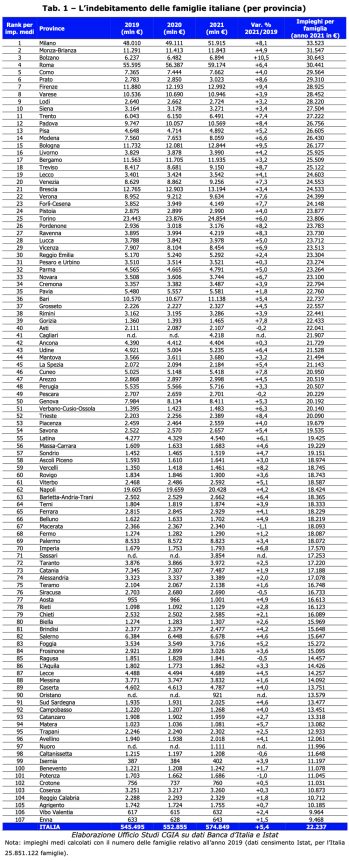

Even though the stock of debt is on the rise and the negative effects of high living and high bills have only exploded since the beginning of this year, the situation is critical, but not dramatic. The increase is likely to be partly attributable to the strong economic recovery that took place last year. It should also be noted that the most indebted provincial areas are also those with the highest income levels. Surely in these realities among the indebted there are also nuclei belonging to the weakest social groups. However, the strong banking exposures of these territories could be linked to the significant investments made in recent years in the real estate sector which, obviously, are attributable to wealthy families. Another thing, however, is to interpret the data from the South; although in absolute terms the situation is less critical than in the rest of the country, the debt burden of the poorest families is certainly greater than elsewhere. It should also be remembered that the greatest incidence of debt on income is recorded in the economically weakest households, that is, in those at risk of poverty and social exclusion. Furthermore, Istat data tells us that the crises that have occurred since 2008 have increased the number of families in economic difficulty, given that the effects of these economic shocks have increased the gap between poor and rich.

BILLS: THE AUTONOMOUS ARE PAYING THE INCOME TWICE

The exponential increase in prices, high fuel prices and energy bills could considerably worsen the economic situation of many Italian families. We point out, in particular, that many artisans, small traders and VAT numbers are paying twice the extraordinary increase recorded in the last 6 months in electricity and gas bills. The first as home users and the second as small entrepreneurs to heat and light their workshops and shops. A situation that for many businesses is becoming impossible to sustain.

WEAR: ARTISANS, DEALERS AND VAT NUMBERS AT RISK

With only the complaints made to the judicial authority it is not possible to measure the usury. This phenomenon is very "karst"; whoever ends up in the network of these criminals is often afraid of denouncing his tormentors because he fears for the safety of himself and his family. And with the economic crisis now upon us again, even the police have for some time been denouncing many signs of the approach of criminal organizations to the world of business. Especially the one made up of artisans, shopkeepers and VAT numbers. Self-employed workers who get into debt for a few thousand euros, but within a few months find it impossible to repay this money, because in the meantime the interest has reached frightening levels. According to the CGIA Studies Office, these are the realities most at risk. This shows that the state must intervene with massive amounts of liquidity, otherwise many companies will fall prisoner of these outlaws. Not only that, but it is necessary to encourage the use of the "Fund for the prevention" of usury. An instrument, the latter, present for decades, but little used, also because it is unknown to most and, consequently, with scarce economic resources available.

MILAN AT THE TOP, THE LESS INDEBITED IN ENNA

The most “red” families are located in the province of Milan, with an average debt of 33.523 euros; in second place we see those of Monza-Brianza, with 31.547 euros and in third place the residents of Bolzano, with 30.643 euros. Just off the podium we see those in Rome, with an average debt that amounts to 30.441 euros, those of Como, with 29.564 euros and those of Prato with 29.310 euros. Among the least exposed, however, we point out the families residing in the province of Reggio Calabria, with an exposure of 10.712 euros, those of Agrigento, with a debt of 10.185 euros and those of Vibo Valentia, with 9.964 euros. Finally, the least indebted families in Italy are found in Enna, with a "red" amounting to 9.468 euros.

(see Tab. 1 and Tab. 2).