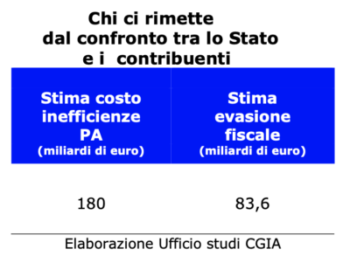

There are reasonable certainties in believing that in the relationship between the State and the Italian taxpayer, the person most penalized by the "damage" caused by the dishonorable conduct of the other is not the first, but the second. Considering a whole series of caveats, which will be highlighted later in this note, the thesis of the CGIA research office is the following: according to the Ministry of Economy and Finance, the economic dimension of tax evasion affecting Italians would amount to 83,6 billion euros (report on the unobserved economy and on tax and contribution evasion - Updates for the years 2016-2021 following the revision of the national accounts carried out by Istat - pag. 5, January 2024). Resources which, due to the fiscal infidelity of some, are taken away from the State and therefore from the community, damaging in particular the weakest social groups in the country. An amount, however, equal to half of what citizens and businesses would be called upon to "support" as a result of the waste, squandering and inefficiencies present in the Public Administration (PA) and which, according to the artisans of Mestre, would amount to at least 180 billion euros a year.

- In a state of law, everyone must respect the laws. Not just the private sector

Recalling that a rule of law is based, among other things, on the principle of legality, the laws must be respected by everyone: both public and private entities. We would like to point out, however, that the number of European infringements committed by our country demonstrates how our public institutions present one of the highest levels of violation of European law in the EU. We would like to remind you that the procedures still open against Italy include, by way of example, those referring to the failure to respect civil rights, the violation of the rules on the concentration of fine particles present in the air, the presence of arsenic in drinking water , to the continuation of payment deadlines by our PA towards supplier companies and to the pollution levels present in the former Ilva industrial area in Taranto (according to the Department for European Affairs, as of 20 December 2023, there were 69 EU infringement procedures against our country, of which 57 for violation of Union law and 12 for failure to transpose directives).

- Anyone who escapes is not justified in doing so

It is important to clarify one passage: the comparison between tax evasion and waste has no scientific rigor: in fact, the economic effects of public inefficiencies that are "passed on" to private individuals are from different sources, the areas in many cases overlap and, for these reasons , they cannot be added. Having said that, the reasoning nevertheless has its own logical foundation: despite there being a lot of tax evasion, an inefficient PA causes significantly greater economic damage to private individuals. A conclusion, this one from the CGIA Research Office, which does not appear to be at all obvious, since a good part of public opinion has, on the one hand, a strong sensitivity towards the issue of tax evasion, but on the other feels less the effects of waste, extravagance and inefficiencies in the PA are worrying. Let's be clear: this does not mean that tax evasion is justified in the presence of so much waste. God forbid. Instead, it means that tax evasion represents a cancer for our economy and that it must be eradicated. But with the same determination we must also eliminate the inefficiencies which, unfortunately, negatively characterize the performance of our public machine. The slowness with which many public offices and our justice system work, or the waste present in healthcare and local public transport require immediate removal.

- With less waste, perhaps, we would also have less evasion

It is also clear to everyone that if we recovered a good part of the resources hidden from the tax authorities, our public machine would have more resources, it would work better and, perhaps, the tax burden could be reduced. But it is equally plausible to assume that if it were possible to significantly cut the inefficiencies present in public spending, the country would benefit and, most likely, tax evasion and tax pressure would be lower. It is no coincidence that many claim that fiscal loyalty is inversely proportional to the level of taxes to which their taxpayers are subjected. However, the CGIA would like to point out that it would be wrong to generalize and not also recognize the levels of excellence that characterize many sectors of our PA, such as, for example, healthcare in the central-northern regions, the level of teaching and professionalism present in many universities /research bodies and the quality of the work carried out by the police.

- What doesn't work about our PA

The CGIA Research Office has taken up and aligned the results of a series of analyzes of the main inefficiencies that characterize our PA. In summary they are:

- the annual cost incurred by companies for managing relations with the PA (bureaucracy) is equal to 57,2 billion euros (Source: The European House Ambrosetti);

- the commercial debts of the PA towards its suppliers amount to 49,5 billion euros (Source: Eurostat);

- the slowness of justice costs the country system 2 points of GDP per year which is equivalent to 40 billion euros (Source: Minister of Justice, Carlo Nordio);

- the inefficiencies and waste present in healthcare can be quantified at 24,7 billion euros every year (Source: GIMBE);

- waste and inefficiencies in the local public transport sector amount to 12,5 billion euros per year (Source: The European House Ambrosetti-Ferrovie dello Stato).

As we have already highlighted, the economic effects of these malfunctions, taken from different sources, cannot be added together, also because in many cases the areas of influence of these analyzes overlap. These warnings, however, do not affect the correctness of the result of the comparison made above.

In essence, we can however state that the amount of tax evasion is much lower than the negative effects generated by the poor functioning of our PA which, unfortunately, continues to maintain levels of quality and quantity of services offered that are lower than the European average.

Subscribe to our newsletter!