There are 146 thousand Italian companies that are concretely at risk of usury. Activities that currently employ approximately 500 employees. These are mainly craft enterprises, traders / commercial activities or small entrepreneurs who have "slipped" into the insolvency area and, consequently, have been reported by the financial intermediaries to the Central Credit Register of the Bank of Italy. In fact, this "filing" precludes these activities from accessing a new loan. To say it is the CGIA Studies Office.

• For the entrepreneurs involved it is "civil death"

For the recipients of this measure it is as if they had been sentenced to "civil death"; a legal institution widespread in Europe until the nineteenth century which involved the loss of all civil rights and the consequent removal from society for the condemned. We recall, in fact, that whoever is registered with the Central Credit Register can hardly benefit from any financial help from the banking system, risking, much more than the others, to close or, worse still, to slip into the arms of the usurers. To prevent this criticality from spreading, the CGIA continues to strongly ask for the strengthening of the resources available to the "Usury Prevention Fund". The latter is a tool capable of constituting the only valid help to those in this vulnerable situation. It is good to remember that entrepreneurs who "end up" on this black list of the Bank of Italy do not always owe it to poor financial management of their company. In most cases, in fact, this situation occurs as a result of the impossibility of many small entrepreneurs to collect payments from clients or for having "fallen" into a bankruptcy that involved the latter.

However, it should be noted that in the last year the total number of activities reported to the Central Credit Register fell by over 30 thousand units. This is due, in particular, to the "prevention" activity triggered by the significant public guarantee measures and the debt moratorium for SMEs introduced in Italy from 2020 to counter the pandemic crisis that has significantly increased the overall stock of loans disbursed to production activities. These initiatives have been extended several times. Lastly, until next December 31st, after which date, the deferral could end definitively.

• More resources to the "Usury Prevention Fund"

The "Usury Prevention Fund" was introduced with Law No. 108/1996 and began to operate in 1998. This fund was introduced for the disbursement of contributions to collective credit guarantee consortia or cooperatives or foundations and Associations recognized for the prevention of the phenomenon of usury. All the aforementioned entities can contribute to the prevention of usury by guaranteeing banks for medium-term loans or short-term credit lines in favor of small and medium-sized enterprises that have already been refused an application for intervention by a bank. This measure allows financially weak operators to access legal financing channels and on the other hand helps victims of usury who, not carrying out a business activity, are not entitled to any loan from the “Solidarity Fund”. The "Prevention Fund" provides for two types of contributions. The first is intended for Confidi to guarantee loans granted by banks to economic activities. The second is recognized by foundations or associations against usury which are recognized by the MEF. These associations allow people in serious economic difficulty (employees and retirees) to access credit safely. According to the latest available data, in the first 22 years of life, the average amount of loans disbursed by this fund was approximately 50.000 euros for SMEs and 20.000 euros for citizens and families. The same is mainly fed by the administrative anti-money laundering and currency penalties. From 1998 to 2020, the State provided 670 million euros to Confidi and Foundations; these resources guaranteed loans for a total amount of approximately 2 billion euros. In 2020, the two disbursing bodies (Confidi and Foundations) were assigned a total of 32,7 million euros: of which 23 million to the former and 9,7 million euros to the latter. Important figures that, however, according to the CGIA Studies Office should be implemented: the crisis, unfortunately, has pushed many companies to the brink of bankruptcy. Activities that, if not helped, risk slipping into insolvency or, at worst, into the network set up by those who want to take possession of them by deceit, thus fueling the criminal economy.

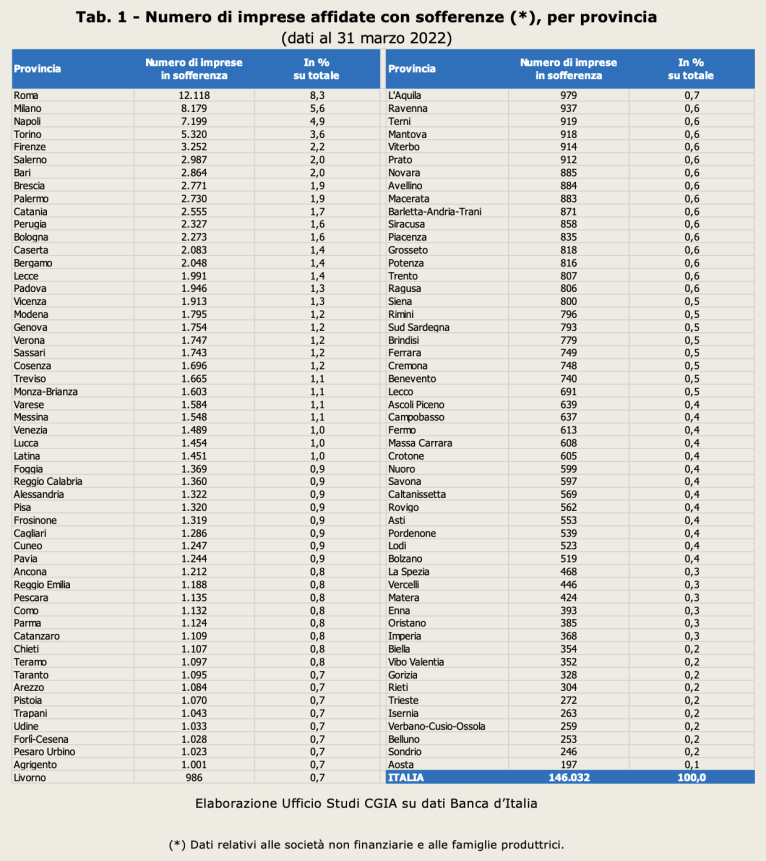

• One in 3 companies at risk is in the South. The most critical situations are in Rome, Milan, Naples and Turin

At the provincial level, the highest number of companies reported as insolvent is concentrated in large metropolitan areas. As of March 31, Rome was in first place with 12.118 companies: immediately after we see Milan with 8.179, Naples with 7.199, Turin with 5.320, Florence with 3.252 and Salerno with 2.987. The provinces least affected by this phenomenon, on the other hand, are those which, in principle, are the least populated: such as Belluno (with 253 companies reported to the Centrale Rischi), Sondrio (246) and Aosta (197).

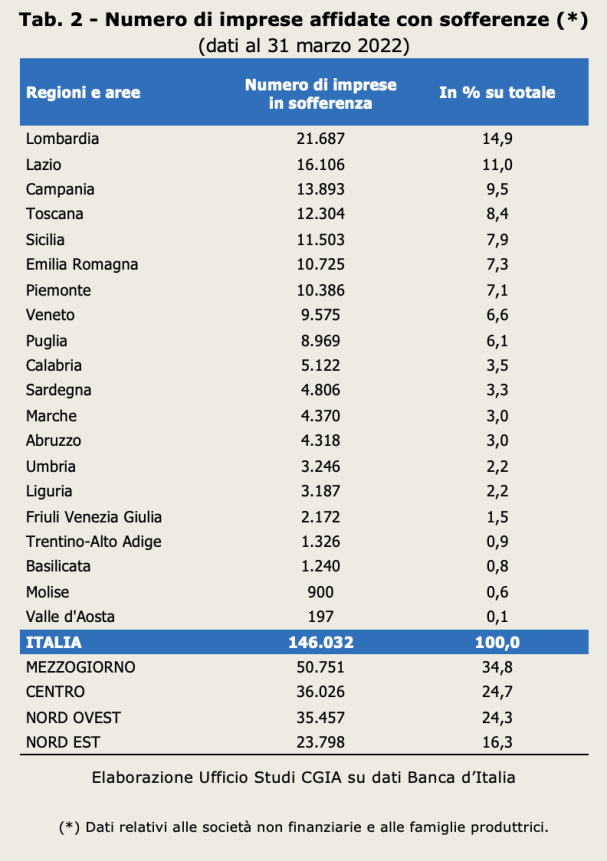

If we analyze the data by territorial division, we realize that the area most at "risk" is the South: here there are 50.751 companies in distress (equal to 34,8 per cent of the total), followed by the Center with 36.026 companies (24,7, 35.457 percent of the total), the Northwest with 24,3 (23.798 percent of the total) and finally the Northeast with 16,3 (XNUMX percent of the total).

• The complaints of usury start to increase again

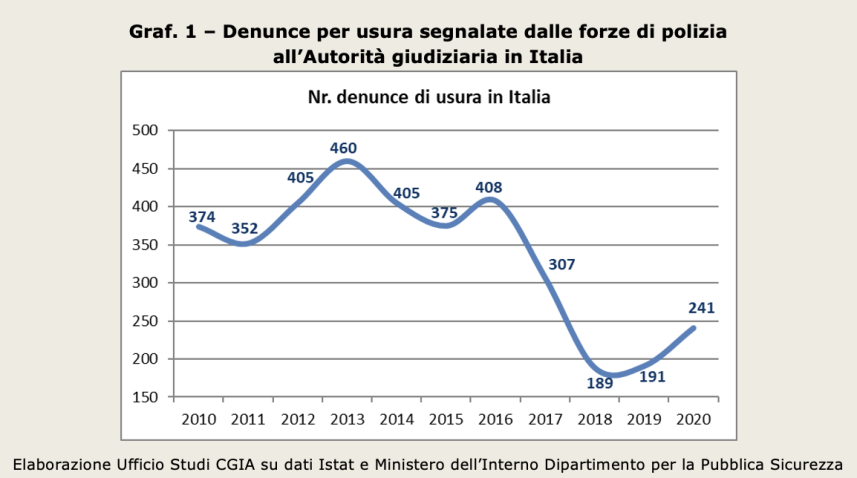

Although with only the complaints made to the judicial authorities it is not possible to accurately size the phenomenon of usury, after the strong contraction recorded between 2017 and 2018, subsequently the same began to grow again.

Although the absolute number is much lower than the peaks recorded in the first part of the last decade, according to the Ministry of the Interior in 2020 (the last year in which the data are currently available), the complaints, due to the economic crisis caused by Covid, rose to 241 (+26,1 percent compared to 2019). It should also be noted that in 2020 of all crimes against property, complaints for usury and fraud, especially IT, were the only ones to register a positive change.

• The rise in small business lending has faded

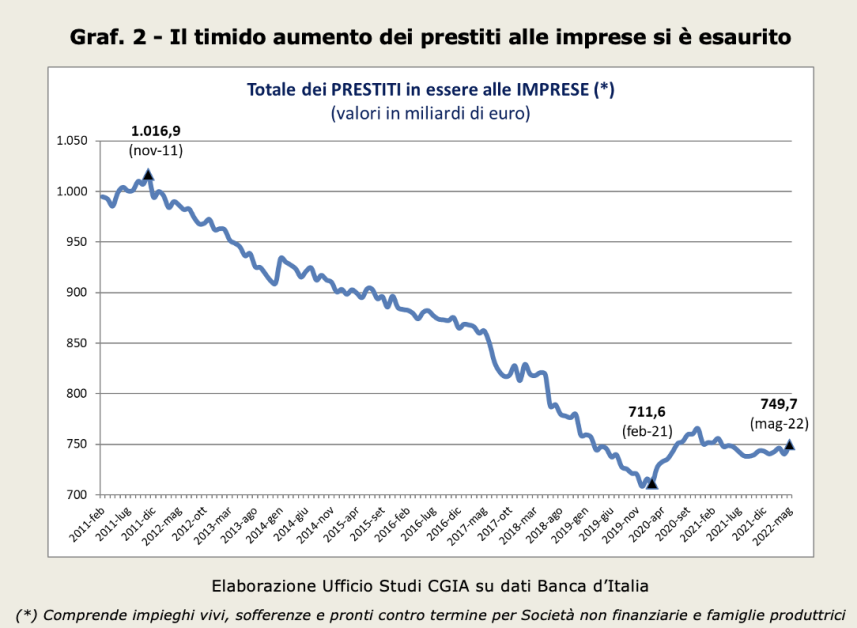

As reported by the Bank of Italy, after the strong expansion that occurred in 2020 (+7,4 per cent), last year the growth of total loans disbursed by banks and financial companies to businesses suffered a marked slowdown (+1,7 , 1,4 percent) which continued in March of this year (+2021 percent compared to the same month in 2020). This deceleration is attributable to the fact that demand has undergone a strong contraction; in fact, after the strong increase that occurred in 2022, thanks to the anti-crisis measures put in place by the then Conte government, subsequently the request for credit by entrepreneurs has decreased. It should also be noted that, in March 2021 to March 20, the change in loans granted to companies with fewer than 0,4 employees was negative (-XNUMX per cent).

The via Nazionale researchers argue that this result is attributable to the "lower propensity of banks to finance more opaque and relatively more vulnerable companies". Indirectly, they confirm what we feared; the economic difficulties that have emerged in the last six months are affecting the smallest and for the banks it is better not to risk helping those in difficulty. A strategy that risks involuntarily “pushing” many entrepreneurs towards criminal organizations which, especially in difficult times, instead need to reinvest the money coming from criminal activities in the legitimate economy.