There are just under 176.400 Italian companies that are in distress; among these, one out of three is located in the South. Rome, Milan, Naples and Turin are the territorial realities most in difficulty. We are talking about non-financial companies and producer households that have been reported as insolvent by the financial intermediaries to the Central Credit Register of the Bank of Italy. A "stamp" which, by law, does not allow these companies to access any loan provided by the legal financial channel. Therefore, not being able to benefit from liquidity, they risk, much more than the others, of closing down or slipping into the arms of the usurers. To prevent the number of these troubled companies from increasing, the CGIA hopes that the Draghi government will enhance the resources available to the “Usury Prevention Fund” and help banks to support businesses, especially small ones. Thanks to the activation of these two measures, the overall stock of distressed companies should not grow.

• The most critical situations in Rome, Milan, Naples and Turin

As expected, at the provincial level the highest number of companies reported as insolvent is concentrated in large metropolitan areas. As of March 31, Rome was in first place with 13.310 companies: immediately after we see Milan with 9.931, Naples with 8.159, Turin with 6.297, Florence with 4.278 and Brescia with 3.444. The provinces least affected by this phenomenon, on the other hand, are those which, in principle, are the least populated: such as Belluno (with 360 companies reported to the Centrale Rischi), Isernia (333), Verbano-Cusio-Ossola (332) and Aosta (239).

If we analyze the data by territorial division, we realize that the area most at "risk" is the South: here there are 57.992 companies in distress (equal to 32,9 per cent of the total), followed by the Center with 44.854 companies (25,4, 43.457 percent of the total), the Northwest with 24,6 (30.070 percent of the total) and finally the Northeast with 17 (XNUMX percent of the total).

• Strengthen the "Usury Prevention Fund"

The "Usury Prevention Fund" was introduced with Law No. 108/1996 and began to operate in 1998. This fund was introduced for the disbursement of contributions to collective credit guarantee consortia or cooperatives or foundations and Associations recognized for the prevention of the phenomenon of usury. All the aforementioned entities can contribute to the prevention of usury by guaranteeing banks for medium-term loans or short-term credit lines in favor of small and medium-sized enterprises that have already been refused an application for intervention by a bank. This measure allows financially weak operators to access legal financing channels and on the other hand helps victims of usury who, not carrying out a business activity, are not entitled to any loan from the “Solidarity Fund”. The "Prevention Fund" provides for two types of contributions. The first is intended for Confidi to guarantee loans granted by banks to economic activities. The second is recognized by foundations or associations against usury which are recognized by the MEF. These associations allow people in serious economic difficulty (employees and retirees) to access credit safely. In these 22 years of life, the average amount of loans disbursed by this fund was approximately 50.000 euros for SMEs and 20.000 euros for citizens and families. The same feeds mainly on the administrative anti-money laundering and currency penalties. From 1998 to 2020, the State provided 670 million euros to Confidi and Foundations; these resources guaranteed loans for a total amount of approximately 2 billion euros. In 2020, the two disbursing bodies (Confidi and Foundations) were assigned a total of 32,7 million euros: of which 23 million to the former and 9,7 million euros to the latter. Important figures that, however, according to the CGIA should be implemented: Covid, unfortunately, has pushed many companies to the brink of bankruptcy. Activities that, if not helped, risk slipping into insolvency or, at worst, into the network set up by those who want to get hold of them by deceit, thus fueling the criminal economy.

• The complaints of usury start to increase again

Although with only the complaints made to the judicial authorities it is not possible to accurately size the phenomenon of usury, after the strong contraction recorded between 2016 and 2018, subsequently the same began to grow again.

Although the absolute number is much lower than the peaks recorded in the first part of the last decade, according to the Ministry of the Interior in 2020, annus horribilis due to the pandemic, the reports have risen to 222 (+16,2 percent compared to 2019). It should also be noted that last year of all crimes against property, complaints for usury and fraud, especially IT, were the only ones to register a positive change.

• September month at "risk" due to tax deadlines

Tax deadlines have always acted as a "trigger", pushing many small companies in economic difficulty to "contact" usurers or criminal organizations to acquire the necessary liquidity to honor these commitments. This year, then, the month of September is by far the richest in tax deadlines, also because the collection and notification of new tax bills by the Revenue Agency resumes. We also remind you that by 15 and 16 September, companies (subject to ISAs, or former sector studies) had to pay personal income tax, IRES, IRAP and VAT. Next Monday, on the other hand, will be the last day for the short-term repentance and the deadline for the payment of the scrapping-ter installments and the balance and excerpt expired on 30 July 31 is scheduled for 2020 September XNUMX. A real tour de force which could put the financial stability of many businesses that traditionally are short of liquidity in serious difficulty: especially in this delicate economic phase.

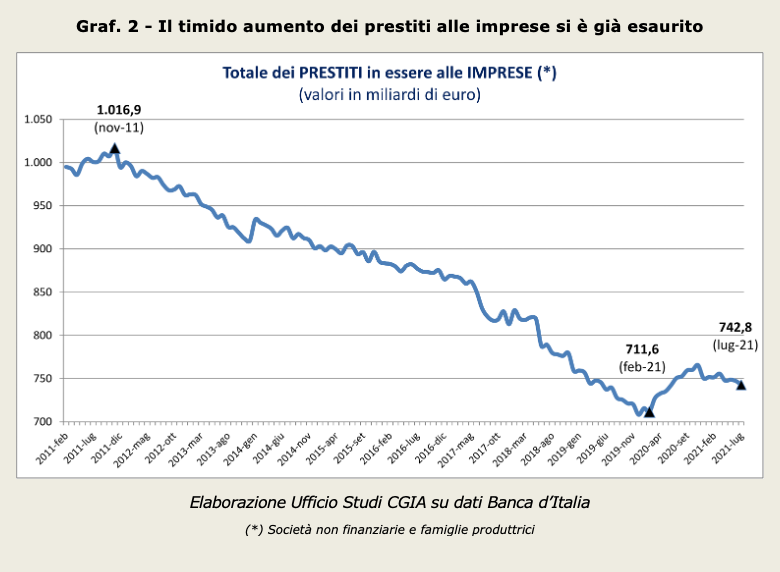

• The rise in business lending has come to an end

After the collapse in bank lending to businesses which took place between November 2011 and February 2020 (-305,3 billion equal to a contraction of 30 percent), it is equally interesting to check the trend recorded in the months following the advent of Covid. .

It should be remembered that if the flow decreases it is evident that there is a serious problem of liquidity and, consequently, of supply by companies which cannot be neglected. Well, after the introduction of the measures developed by the Conte bis government (March 2020), the stock began to grow, reaching its peak in November 2020, and then began a slow decline until last July when it was below quota 743 billion euros. In other words, we can say that, to date, the action to support businesses in credit matters has ended. With respect to the Bank of Italy, on the guaranteed loan front, the Task Force made up of MEF, MISE-Medio Credito Centrale, ABI and SACE updates its data on credit to SMEs more frequently. Through “Garanzia Italia”, for example, up to 7 September the applications submitted by large companies amounted to 3.009 and the volumes of guaranteed loans put in place by SACE reached approximately € 28 billion. Still on the same date, thanks to the “Cura Italia” and the “Liquidity Decree”, the Guarantee Fund for SMEs received 2.326.013 applications which “generated” 191,1 billion in loans. These latest figures also include mini loans up to 30 thousand euros which, on the other hand, recorded 1.167.705 applications, allowing for the disbursement of 22,7 billion in loans.