If, due to the rise in electricity and gas prices, many businesses are at risk of closure, while others, “taking advantage” of this very negative situation, have recorded staggering turnover. This is the case of the energy companies present in Italy which, in the first 5 months of this year, saw revenues increase by 2021 percent compared to the same period in 60. We are talking about industrial extraction of energy raw materials (such as oil, natural gas, etc.) and the refining industry. This was stated by the CGIA Studies Office.

• Recently, never increases in turnover like this year

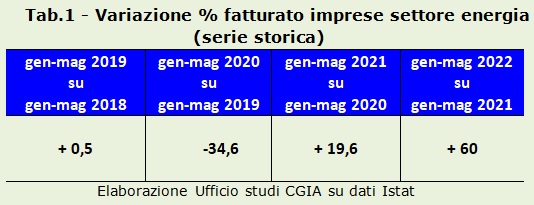

That this is linked to the trend in the prices of energy raw materials is also shown by the data of the last few years. With reference to the January-May period, the growth in turnover of companies in the energy sector in 2019 was +0,5 percent compared to the same period of the previous year; subsequently, in the midst of the pandemic, revenues fell by 34,6 percent (January-May 2020 over the same period of the previous year); otherwise, in the first 5 months of 2021 the change was +19,6 per cent. Finally, this year, turnover has undergone an impressive surge which, as we said, was +60 per cent.

• No fierce taxation on energy companies, but now they pay

Let me be clear: no one is asking for fiscal aggression against large energy companies: it would be unfair. In fact, it should be remembered that an increase in turnover does not necessarily correspond to a similar increase in profit. However, it is clear that the economic result of this sector in the last year has been very positive. And, also for a matter of solidarity and social justice, these realities should pay at least what is imposed by the state with a law to economically "help" the families and businesses most in difficulty. Instead, the big energy companies have been careful not to do so. At least with the first deadline scheduled for last June 30th. We recall that with the Aid decree, energy companies were obliged to apply a 25% rate on the extra profits obtained thanks to the increase in gas and oil prices. Of the 4,2 billion euros expected with the first installment, the state has collected just under 1 billion. If the new rule to recover these lost revenues inserted in the Aid bis decree should not take effect, the Treasury could lose this year over 9 billion of the 10,5 billion foreseen with the introduction of this taxation on extra-profits. Of course, in the face of the increases recorded in recent days, 9 billion euros would do very little to calm the costs of household and business bills. However, it is a question that jeopardizes our social cohesion: in a moment of difficulty like this, those who have more must help those who are worse off.

• Among those who have evaded the tax authorities, are there also companies owned by the state?

We are sure that with the next deadline these entrepreneurial realities will also honor their commitments with the tax authorities, as required by law. It would be unacceptable if this did not happen. First, because an important part of our business would shamefully evade the tax authorities. Secondly, although it is not possible to prove it up to now, among those who have not paid the tax authorities what was requested, we could also include multi-utilities controlled by local authorities or with state participation; if so, in addition to the damage we will also be faced with a real insult.

• Sectors at risk of blackout

With increases in bills that have no equal in the recent history of our country, not only the energy-intensive sectors are more at risk than the others. As regards the consumption of gas, we point out the difficulties that are affecting the companies of glass, ceramics, cement, plastic, brick production, heavy mechanics, food and chemistry etc. As far as electricity is concerned, on the other hand, steel mills / foundries, food, logistics, commerce (shops, shops, shopping centers, etc.), hotels, bar-restaurants, other services (cinemas, theaters, discos, laundries, gyms, sports facilities, etc.).

• The difficulty of the districts

The difficulties, according to the CGIA Studies Office, affect many companies and consequently also many production and non-productive districts which are the engine of the country's economy and exports. Below we report some who have shown important signs of crisis:

- Paper factory of Lucca-Capannori;

- Plastics of Treviso, Vicenza and Padua;

- Metalli of Brescia-Lumezzane;

- Low metalworker from Mantua;

- Metalworker of Lecco;

- Sassuolo tiles;

- Euganean Baths;

- Termomeccanica Padua;

- Murano's glass.

• Solutions? Budget variance and increase supply Today the price of gas is 10 times higher than its historical value: it is as if we paid 20 euros per liter for gasoline. A madness that can hardly be effectively countered. Unfortunately, there are no miracle solutions at these price levels. Of course, it is essential to introduce a price cap at European level, unhook the price of energy from renewable sources from gas prices and further lower taxes, charges and VAT on bills. Some buffer measures can be approved in a reasonably short time; others, more substantial, such as the introduction of a gas price cap, require excessively long approval times, which households and businesses cannot wait. Therefore, what should be done now? First, as has been done with the pandemic crisis, Brussels should ease the rules on public debt and state aid to businesses. In short, it should allow the budget gap, allowing individual countries to borrow to mitigate the increases in electricity and gas for households and businesses. Secondly, the EU should “ask” the Netherlands and Norway to return to being European leaders in the extraction of natural gas. Through a persuasive intervention by the European Council on Amsterdam and Oslo, the increase in production would have very positive effects, even on a psychological level, which, almost certainly, would translate into a reduction in the prices of energy products, allowing all of Europe to pull a sigh of relief.