For the treasury this year will certainly be a Christmas with all the trimmings: under the tree, in fact, he will find a "surprise" worth 513,5 billion euros. This is what the tax revenue of 2021 amounts to. Let me be clear: many taxpayers have not done this "present" with their hearts, but we can affirm that the overwhelming majority "cost" effort, sweat and a lot of work. And never as in this moment of difficulty, everyone hopes that these resources will be spent well, especially for the benefit of those who need them most. To say it is the Studies Office of the CGIA.

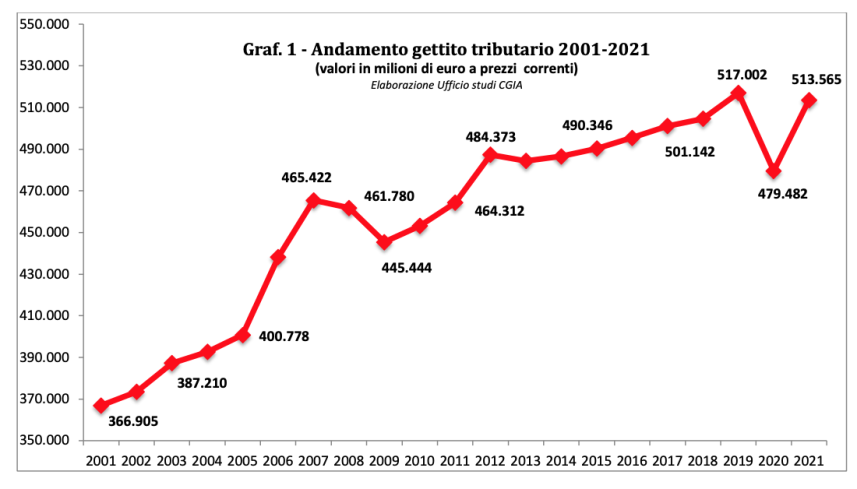

Between direct taxes (Irpef, Ires, Irap, etc.), indirect (VAT) and those on capital account (inheritance taxes, amnesties, etc.), in the last 20 years only in 2019 the revenue was higher than that of this year: although only a little, two years ago the tax authorities were able to collect 517 billion euros (+3,4 billion euros).

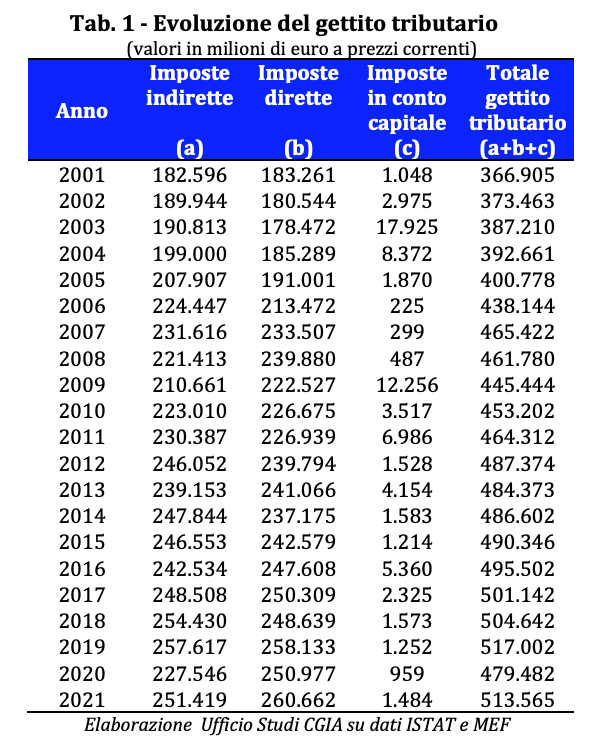

(see Tab. 1).

• Over the last 20 years plus taxes of over 146 billion

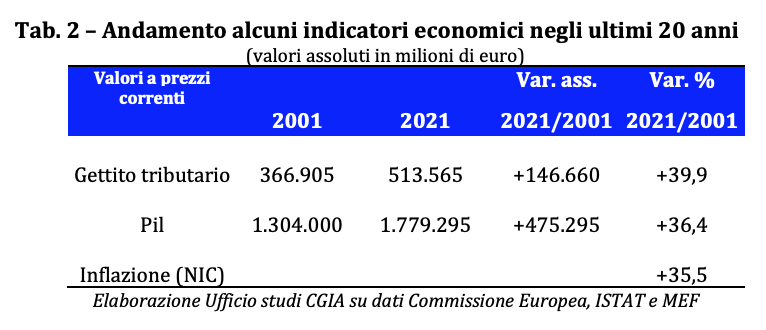

In the last 20 years, a period which practically coincides with the use of the euro, tax revenues in Italy have increased by 146,6 billion euros. If in 2001 the Treasury, the Regions and the local authorities had collected 366,9 billion euros, in 2021 the revenue, at current prices, rose to 513,5 billion (+39,9 per cent). Inflation, again in this period, increased by 35,5 per cent, 4,4 points less than the percentage increase in revenue; GDP, on the other hand, increased by 36,4 per cent, 3,5 points less than the increase in taxes.

(see Tab. 2 and Graph 1).

Can anyone say with full knowledge of the facts that with 146,6 billion more revenue our public machine works better and that Italian taxpayers have received more services, or has this additional levy impoverished them, helping to prevent the country from growing? We have no doubts; we favor the second hypothesis without hesitation.

• Tax: 2022 will be a year of transition

Pending the much-needed tax reform that we hope will be implemented by next year with the enabling law, 2022 will be a year of transition. Of course, the slight adjustment to the personal income tax approved in recent weeks by the government majority will give some relief, but we are still very far from achieving an acceptable result. Not only. In addition to cutting taxes, an operation that can no longer be postponed, it will be necessary to de-bureaucratise the entire tax system. Today we pay too much and in an extremely complex way which for many artisans and many small entrepreneurs translates into an additional cost for the service rendered by the accountant or labor consultant.

• A good cut in the personal income tax, but it is still insufficient

The weakness of the new measure lies in the size of the IRPEF cut that taxpayers will benefit from in 2022: 7 billion is few and completely insufficient to align our tax burden with the European average. However, given the situation of our public finances, any structural reduction in taxes cannot be made in deficit. If we do not want to definitively break the public budget, the resources will be found by cutting public spending by the same amount. And here is the point. We have the impression that no one, even remotely, wants to rationalize public expenditure, especially in the coming years, given that we will have to spend over 235 billion euros with the PNRR. This is why we have many doubts about the success of the next reform that will be defined with the enabling law.

• Only with less spending will we have a strong reduction in taxes

From the CGIA Studies Office they have no doubts: the real challenge is to make the public machine work better and at lower costs. If, in fact, we were able with a stroke of the magic wand to eliminate a good part of the waste and squandering that lurks within our Public Administration (PA), Italian public spending would probably cost much less and, consequently, the the level of the tax burden would be more contained, benefiting those who pay all taxes, down to the last cent. We point out that the annual cost incurred by companies for the bureaucratic management of relations with the PA is equal, according to the Ambrosetti Institute, to 57 billion euros per year. The trade payables that the State and its peripheral branches have towards their suppliers amount to 53 billion euros. Not to mention the bad justice, the infrastructural deficit and the backwardness of our local public transport. In short, if we succeed in modernizing the public machine, citizens and businesses will receive better services at a lower cost and those who govern us will be able to count on more resources to cut taxes.